Yield misconceptions

Feb 24, 2023·Alasdair Macleod

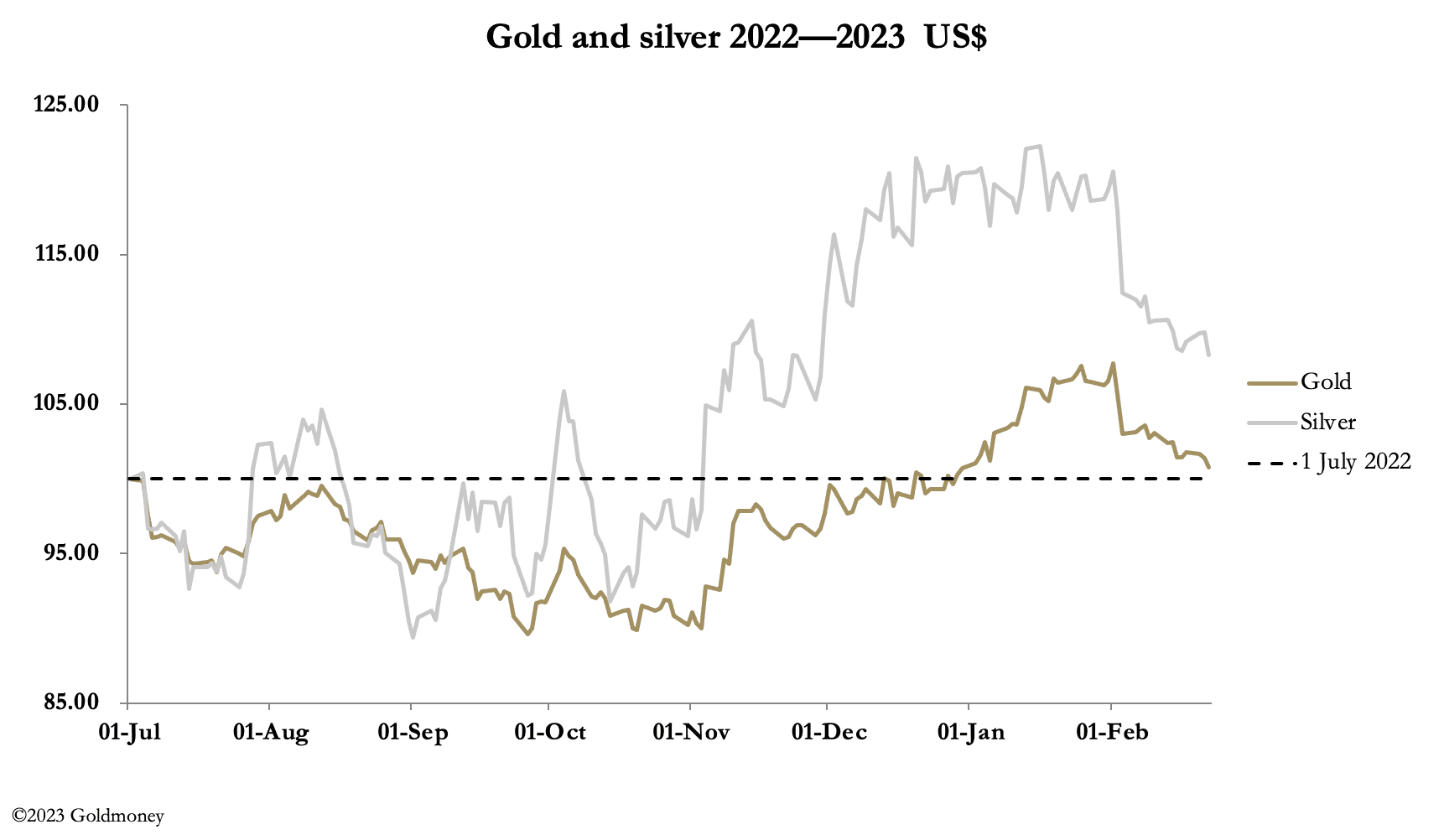

Gold and silver continued to drift lower this week as the dollar continued to consolidate recent falls against other currencies. On the week, gold drifted lower, down $20 from last Friday’s close at $1823 in European trade this morning. Over the same timescale, silver was off 48 cents at $21.20.

The dollar’s trade weighted index has rallied 3.5% since 1 February: hardly earth-shattering, but enough to deter speculative buyers of gold futures. As well as the slightly firmer tone for the dollar, soaring short-term dollar rates are seen as a further deterrent to buyers. These charts for the dollar’s TWI and 6-month Treasury bill yields are next up.

Understandably, the very steep rise in short-term bond yields is causing consternation. They are now twice the level which drove the repo crisis in September 2019. Analysts are expecting a sharp recession to follow, and futures markets are driving down commodity prices in anticipation. WTI oil has sunk to $76 and copper has declined 2% this week. Meanwhile, traders look at the difference in bullion’s yield and over 5% on 6-month and 12-month dollars. Add into the mix that bullion banks are as always short of paper gold, and the vested interest in promoting a bearish view is obvious.

With long bond yields considerably lower than short-term bonds (US 10-year are at 3.9%) a deep recession is being signalled. But this is not the only reason for a steeply negative yield curve, because it is conditional on price inflation declining to under 3%. Confirmation appears to be coming from declining commodity prices.

This analysis is suspect. First, it is speculative commodity paper prices declining, which often lead to a false narrative. The Chinese economy is recovering well and will be further stimulated by China’s pan-Asian investment plans. And secondly, an American slump will lead to massive budget and trade deficits, holes which can only be filled by inflationary monetary policies.

This brings us to a conclusion. Markets are underestimating the future expansion of central bank credit whatever the economic outcome. The loss of international confidence in the dollar and other currencies is bound to drive their purchasing powers lower, and with Chinese and Asian demand for energy and other commodities increasing, forget the transient inflation outcome.

Under these circumstances, it can be demonstrated that the steepness of the negative yield curves in western currencies reflect a serious mispricing of long bond maturities. Do not forget that in the mid-seventies, the UK Treasury had to issue fifteen-year maturity gilts with coupons as high as 15 ½% before the inflation dragon retreated back into its cave.

These were the conditions which drove yields higher all along the yield curve and the price of gold higher as well from $35 in 1970 to $850 in 1980 — an outcome which is denied by conventional thinking today. Added to this misconception are the war signals coming from NATO over Ukraine and increasingly Taiwan. An awakening to these realities will undermine fiat currencies, reflected in far higher gold prices.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.