Silver bear squeeze

Mar 31, 2023·Alasdair Macleod

This week, gold continued to consolidate, while silver moved ahead. This morning, gold was at $1979, up $2 since last Friday’s close, while silver at $23.85 was up 66 cents, for a two week gain of $1.33. Admittedly, silver has not yet recovered the levels in January, unlike gold.

Much of this is down to silver’s volatility. But because silver is no longer regarded in the markets as a monetary metal, it is gold which has benefited from banking jitters, while derivative traders were busy shorting silver along with other metals, expecting a bank crisis to increase the odds of an economic slump.

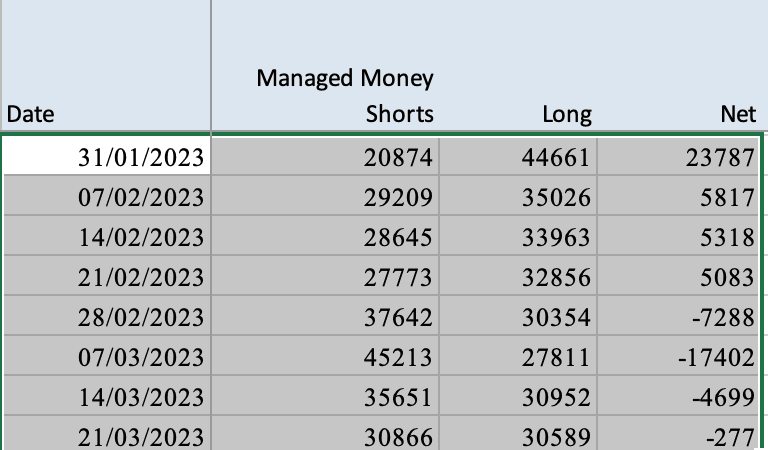

Now that the Commitment of Traders reports have been resumed, we can see that the hedge funds (Managed Money category) were seriously short in early-March, marking the lowest price at $20.

The figures in the spreadsheet above show that they were still net short by 277 contracts when the price had risen to $22.40, and the further rally to today’s level continues to be a squeeze on the shorts. Meanwhile the Swaps, who are normally short, had built their net long position to 11,710 contracts by the 21 March. We can expect these figures to be updated later this evening.

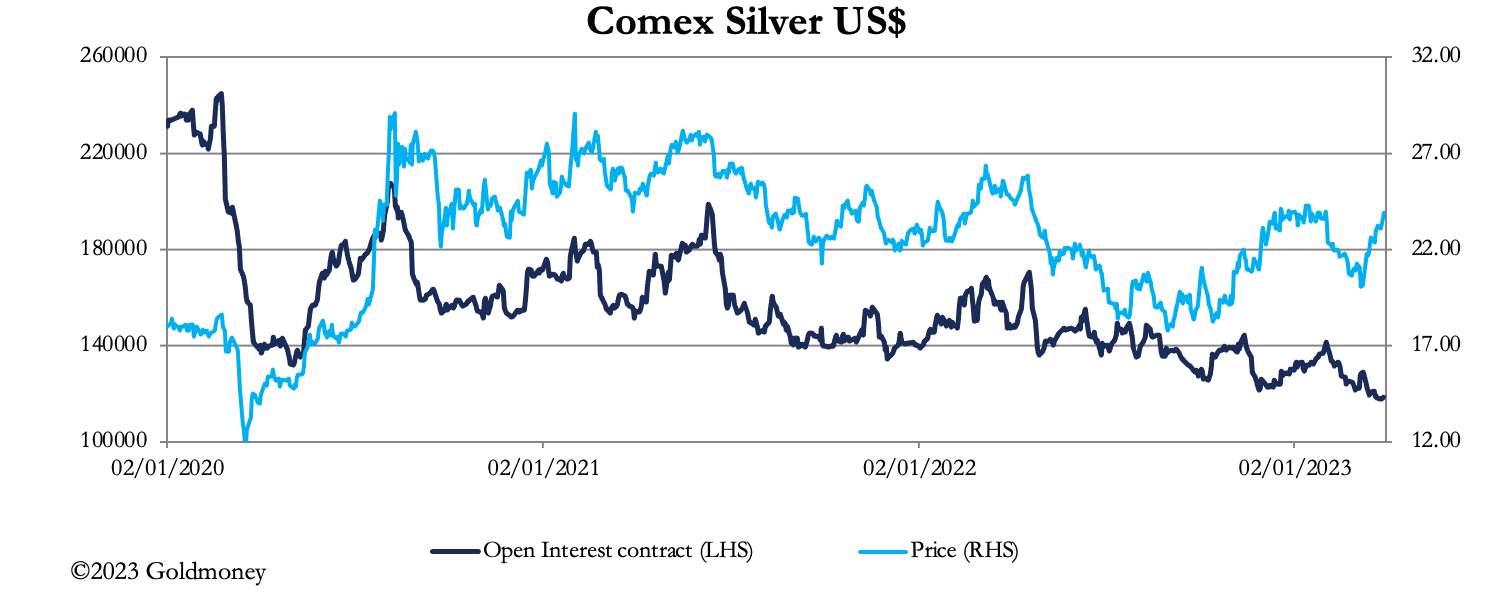

Evidence of the oversold condition is also found in Comex’s Open Interest, which on Tuesday at 117,395 contracts hit the lowest level since the 21 October 2013 — nearly ten years ago. This is next.

There are some technical similarities with the position in March 2020, when Open Interest dropped to 140,000 contracts, taking the price down with it, before both price and OI rallied smartly. Only this time the bullish dynamics appear to be more powerful.

The position in gold is different, as noted above. On 21 March, the Managed Money category was net long 81,229 contracts, against a long-term neutral position of about 110,000 net long. As usual, hedge funds give money to the bullion banks by selling low and buying high. So as the banking situation evolves and the dollar weakens, we can expect more buying attempted from this category.

But we can be certain that banks will be looking carefully at their risk exposure in the widest sense, not just to contain losses, but to foster a reputation for sound management — no bank can afford to do otherwise for fear of a run on deposits. The position on Comex, reflected in the COT Swaps figures, is shown below.

Specifically, the value of their gross and net shorts is $47bn and $28bn respectively. This is about as low as it gets, and banks are unlikely to want their books to get any larger. This means that they will duck out of selling to hedge funds and the Other Reported category as much as possible. Furthermore, the drain on their physical stocks continues, with nearly 15 tonnes stood for delivery in March alone.

While the squeeze on silver is obvious, the developing position in gold looks likely to get more interesting as well.