Market Report: Interest rate outlook clarifying

Feb 4, 2022·Alasdair Macleod

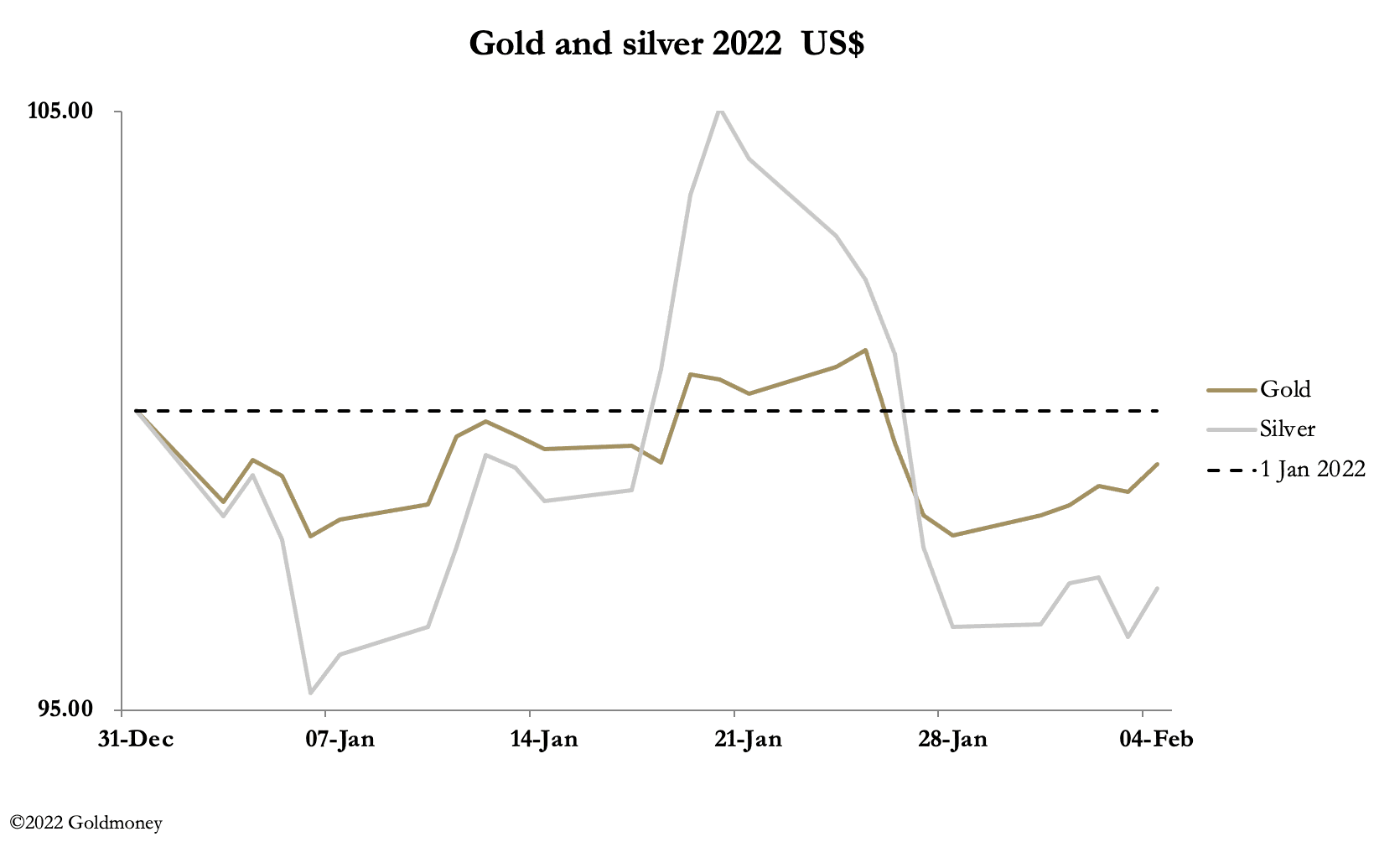

Gold and silver prices were subdued this week as markets absorbed a Bank Rate increase by the Bank of England to 0.5%, and the ECB held its deposit rate unchanged at minus 0.5%. From last Friday’s close, gold rose $23 to $1813 in early European trade this morning, and silver was up 15 cents at $22.60 on the same timescale.

This week, the Bank of England raised its Bank Rate to 0.5%, with some members of the Monetary Policy Committee opting for 0.75%. The ECB announced no change in its deposit rate but warned it would take longer for price inflation in the Eurozone to come back under control than first thought.

Financial markets were shocked by these developments, with equities, bonds and gold initially marked down yesterday (Thursday). But gold quickly stabilised from a near $20 fall, recovering to close only $2 down before rallying further this morning.

Clearly, both central banks and markets are beginning to realise the need to adjust to the consequences of persistent and increasing inflation and the likely impact on interest rates. While exceedingly bearish for bonds and equities along with residential property prices, being driven by Keynesian beliefs the investment establishment has the relationship between gold and interest rates wrong.

Rising interest rates do not represent the cost of money as commonly thought, and the prospects for further rises therefore have nothing to do with controlling inflation. Even though market participants may not realise it, interest rates reflect the market view of currency debasement, being compensation to holders of a fiat currency for their expectations of the currency’s loss of purchasing power.

The empirical evidence confirms this reasoned view. In November 1976 the gold price was $130, and the Fed Funds Rate was 4.95%. By January 1980 gold had risen 535% to $825 and the FFR nearly tripled to 13.82%. Fast forward to June 2004 when the FFR stood at 1% and gold at $385. By August 2006 the FFR rose to 5.25%, and gold to $650. Clearly, the gold price correlated with rising interest rates, confirming that interest rates cannot be the “price” of money.

The current position is that rising prices are driven by an unprecedented recent expansion of global currencies and credit, in other words debasement. Markets are just beginning to wake up to the potential price effects for consumer prices, and in the coming months will almost certainly conclude that interest rates have much further to rise. That being so, gold also has further to rise priced in debased currencies, just as they have in the past.

The chart below shows gold’s technical position, which is of a contracting triangle consolidation, ready to break out and mirror the move from August 2018 to August 2020 when it rose 79% from $1160 to $2075. On technical analysis grounds alone, this indicates a price target of $1800 X 1.79% = $3,220.

This is not a forecast, just a technical analysis indication of what might be in store as the consequences of past and current monetary debasement affect prices generally.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.