Market Report: Gold challenges all-time high

Mar 11, 2022·Alasdair Macleod

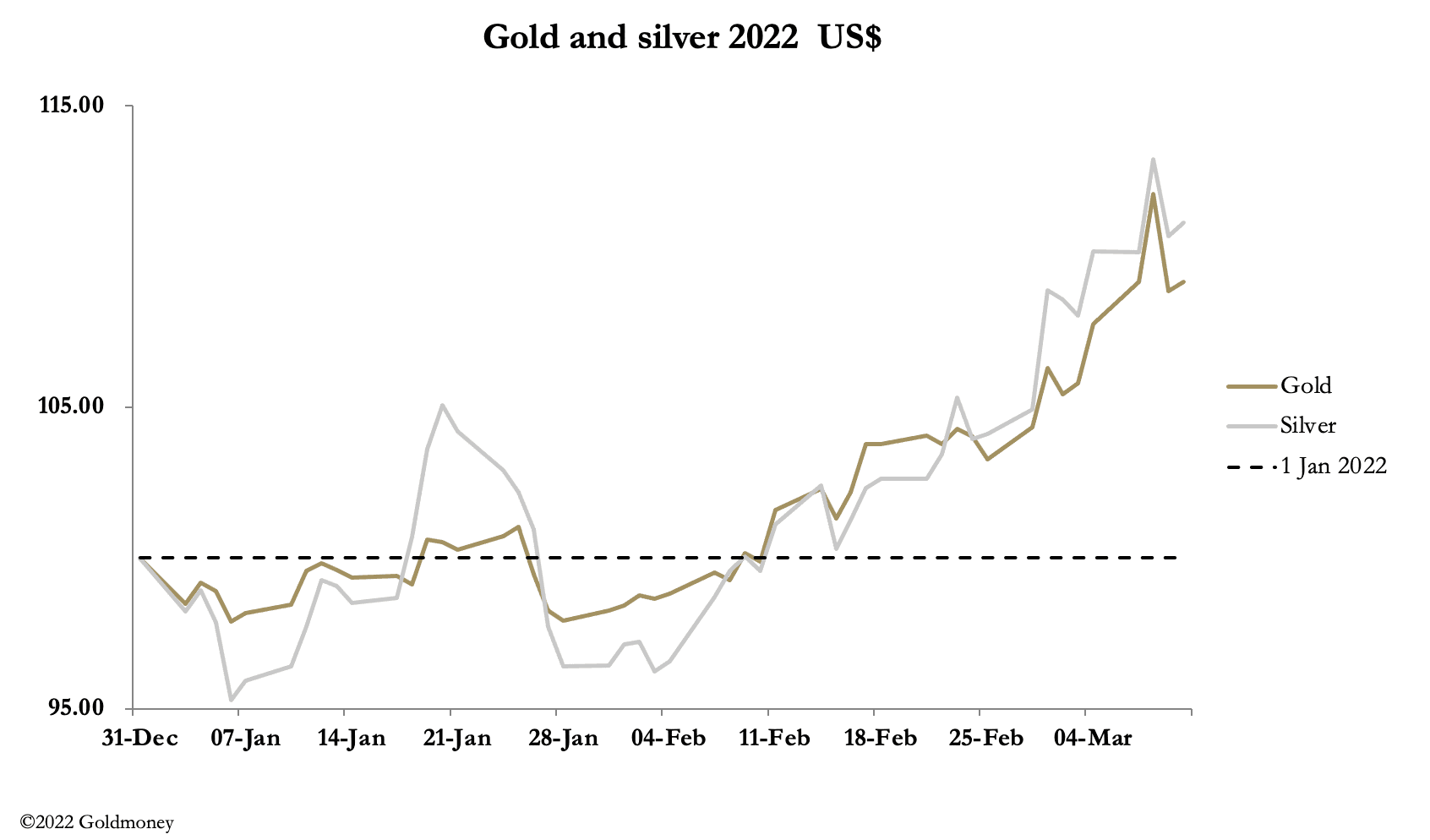

As commodity prices responded to developments in Ukraine, precious metals rallied strongly before a general consolidation developed across all markets. After hitting a high of $2070 on Tuesday, gold backed off to trade at $1990 in this morning’s European trade, up a net $19 on the week. Silver touched $26.93 before falling back to $25.80 this morning, up a net 15 cents.

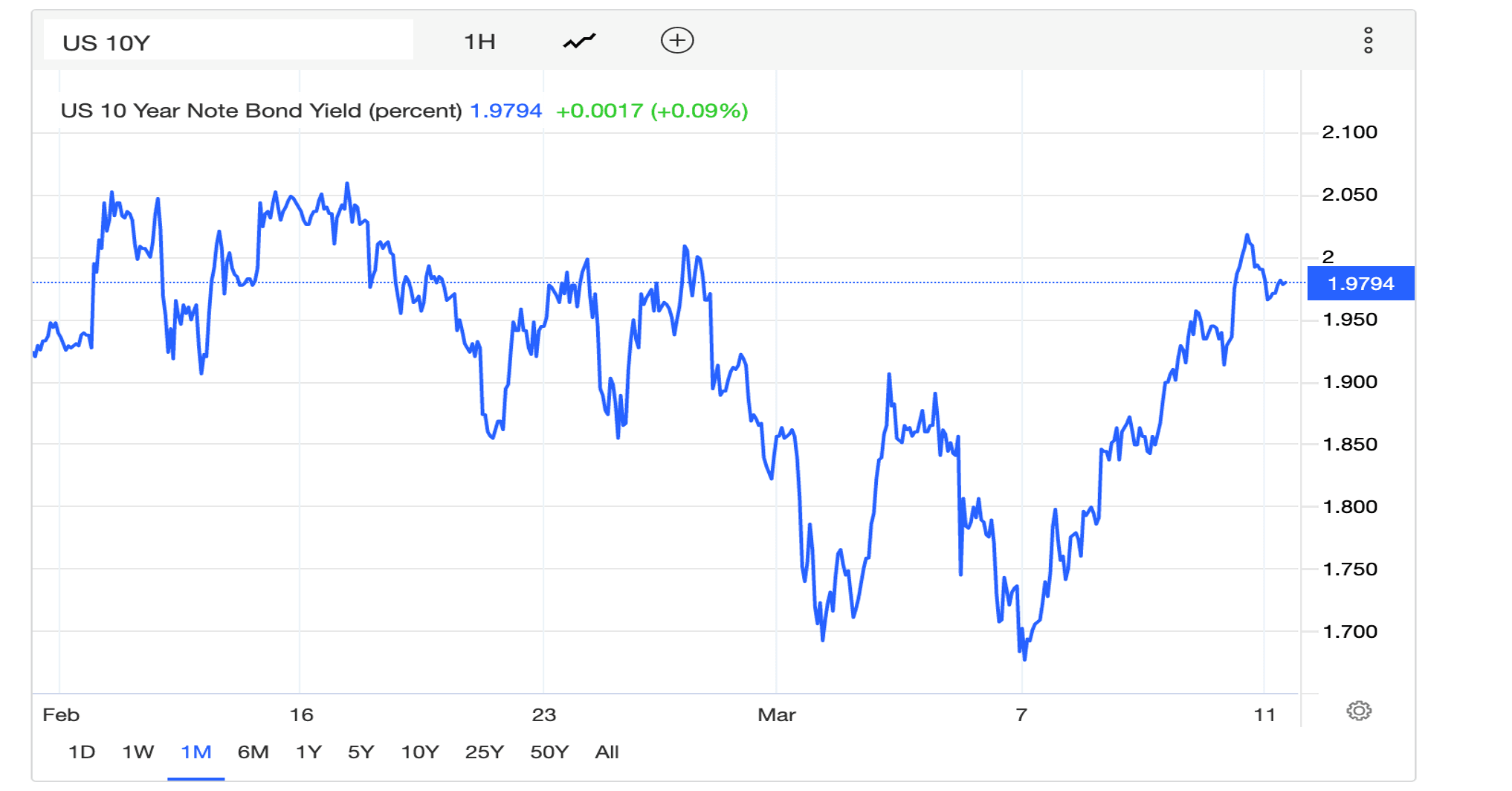

Oil prices also backed off, with WTI this morning at $108 after touching $129.40. The flight to fiat safety has also reversed, as our next chart of the 10-year UST from Trading Economics shows.

Last week the yield on the 10-year UST note fell from over 2% to 1.68% by last Friday before a pre-weekend rally. This week, the yield rose to 2% again, telling us that on balance the market was becoming less worried about the Ukrainian war and more concerned with the highly negative real yields on offer. By way of confirmation, it was announced yesterday that the US CPI rose to 7.9% in February in line with expectations.

On Comex, gold’s Open Interest has risen above recent levels, putting pressure on the Swaps, which account for the bulk of the short side. The Swaps are mainly bullion bank trading desks.

In money terms, their gross short positions are now at record highs.

In money terms, their gross short positions are now at record highs.

Clearly, in this new commodity environment, the bullion banks will wish to reduce their short positions before they run away further out of control. At the beginning of this year, there were 28 Swaps short of an average position of $1.67bn. Last Tuesday, there were 23 Swaps short of an average position of $2.59bn. We don’t know the variance from the average, but there may be some traders short of over $3bn of Comex contracts. Their senior managers and treasury departments are bound to be asking questions.

This might explain the markets counterintuitive behaviour, when on Tuesday Comex Open Interest fell by 7,209 contracts on the day gold hit its high point. This can only happen if a combination of Producers/Merchants and Swaps cut their shorts. And with prices rising to these levels, it is likely that Producers increased their shorts, which can only mean that the Swaps managed reduce their shorts by as much as 15-20,000. We will find out the true figures when the Commitment of Traders figures are released after trading hours today.

Meanwhile, a negotiated settlement to the Ukrainian invasion does not appear to be in sight. But this week, Sergei Lavrov, the Russian Foreign Secretary in negotiations with his Ukrainian opposite number in Turkey effectively opened a possible route for peace negotiations. If Ukraine undertakes to be neutral, not joining NATO nor the EU, then Russia can back down. This might be doable, but America is likely to baulk at letting Putin off the hook so easily. It might not happen, but for precious metal traders it cannot be ruled out. And if serious negotiations start, there may be some short-term downside in prices.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.