Market Report: Gold and silver advance

Oct 22, 2021·Alasdair Macleod

On the back of generally thin Comex trade gold and silver made positive headway this week. In European trade this morning, gold was $1793, up $26 from last Friday’s close, and silver was $24.33, up $1.08 cents.

Precious metals are at an interesting juncture. We can only go on Comex figures, representing perhaps 10% of total non-option derivatives. But if they are any guide, the firmer undertone, lowish volumes for gold and no increase in open interest signal classic bear squeeze conditions — the bears being predominantly the Swaps, three-quarters of which are bullion bank trading desks. These traders are running out of time ahead of the Basel 3 deadline in London only eleven weeks away.

On the last Commitment of Traders figures (12 October) bullion banks would have been net short about 117,000 contracts, out of the Swaps total net shorts of 159,774. That’s the equivalent of 364 tonnes of gold in paper form to be wound down. Our next chart shows the monetary value of the total swaps position — $41.8bn gross and $28.1bn net.

Turnover in the Comex silver contract was higher than that of gold, but again, open interest hardly changed on the week. This indicates book-squaring rather than new interest, and again can be taken as bullish.

Major base metals remain in backwardation, with copper’s particularly noticeable. It seems that commodities trader, Trafigura, has not only been particularly bullish, but has accumulated physical metal, draining LME inventories. Nickel has been hitting seven-year highs, and energy-intensive refining costs of steel, aluminium and cement are also having an impact., restricting supply.

Anecdotal information from China suggests that industrial production is being adversely hit by uneconomic input prices, including rising energy costs, as well as continuing logistics problems. There is lingering hope in some quarters that declining production will ease the rise in prices for industrial materials and raw materials.

That is all very well, and there is yet more global evidence of a developing slump in production. But analysts focusing on purely supply and demand factors are missing a bigger picture of the effect of increases in the supply of currency and credit on the dollar’s purchasing power. But economics, money and credit are not subjects widely understood, even in the investment and financial communities.

These communities are gradually awakening to inflationary problems. Increasingly they are quoting stagflation, which on further enquiry describes a condition they do not understand. But we can take it that this description is a waypoint on the route to a discovery that far from commodity prices rising, it is the purchasing power of fiat currencies falling.

Another step in this journey is the commentary about bitcoin’s revival, whose price hit a new high of $67,000 on Wednesday. JP Morgan’s analysts are quoted this morning’s Daily Telegraph as saying, “We believe the perception of bitcoin as a better inflation hedge than gold is the main reason for the current upswing… triggering a shift away from gold [funds] into bitcoin funds since September”.

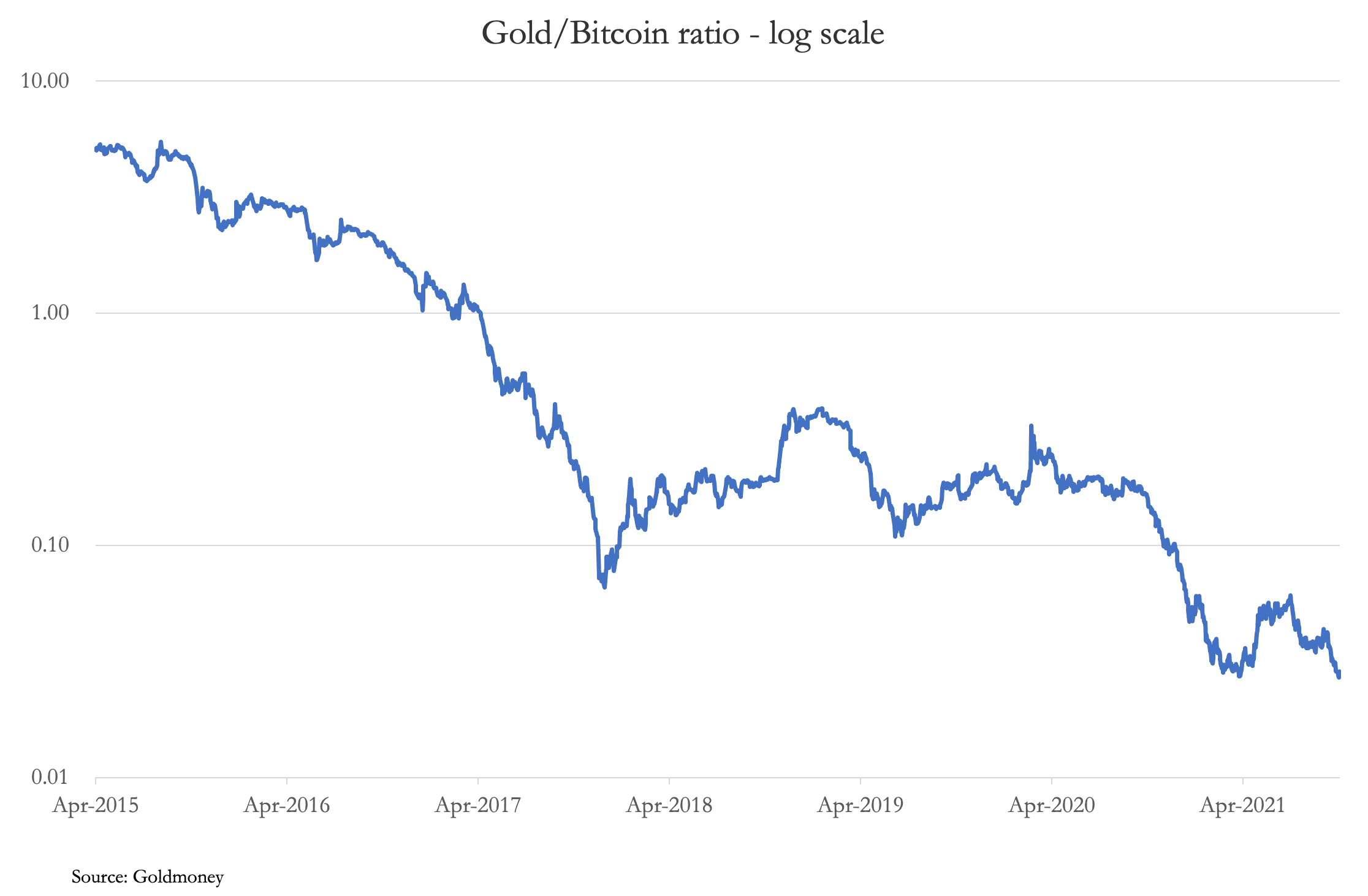

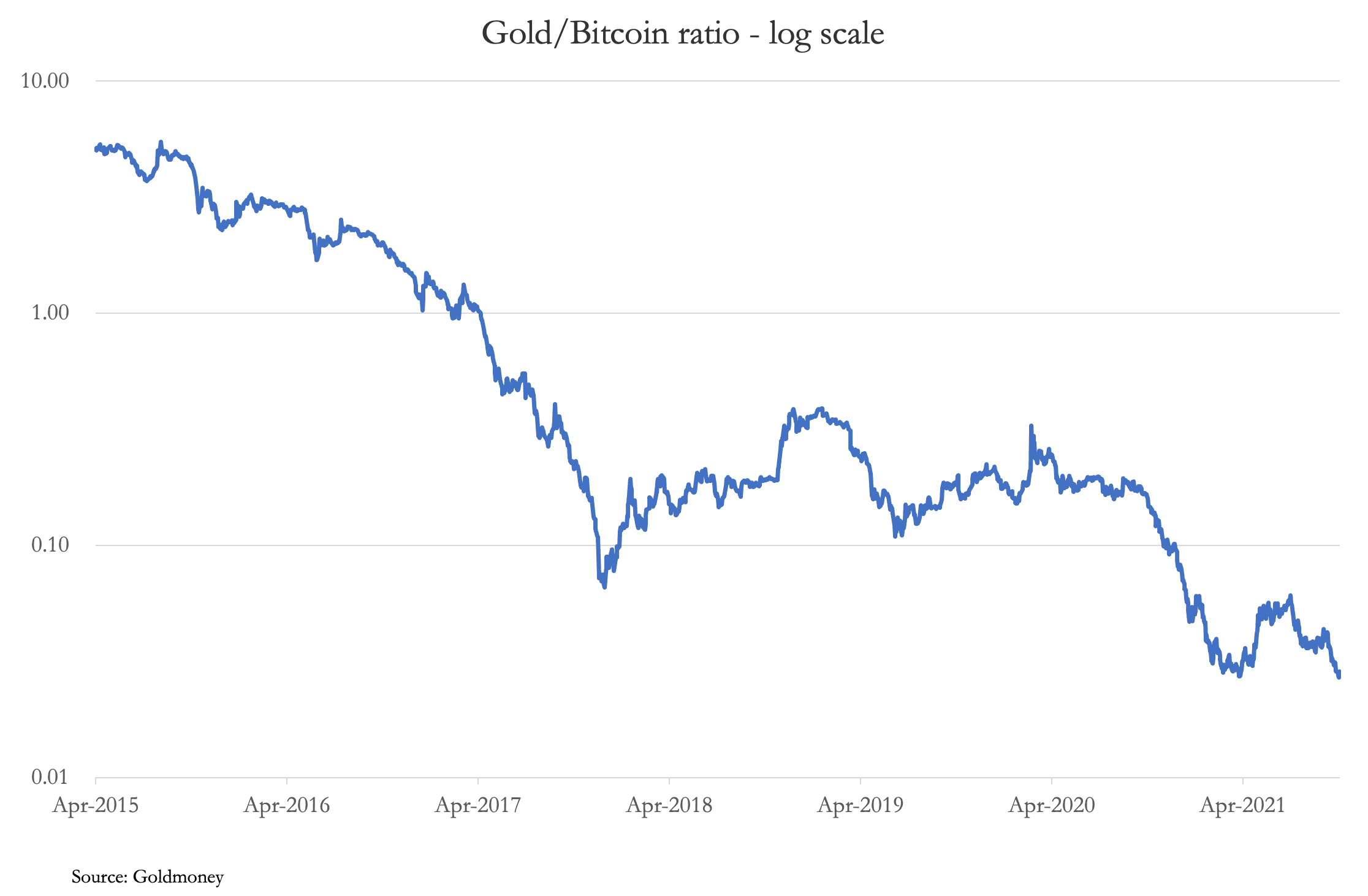

This is consistent with an understanding of monetary affairs progressing as far as a relative supply argument between fiat and bitcoin, but a long way from reasoned analysis. Our final chart shows the ratio of gold to bitcoin.

Like trend-chasing amateur investors, JP Morgan’s clients are piling into something they half understand after the ratio has fallen from 5.00 to 0.03 (99.4%!), indicating that as inflation hedges established gold is incredibly cheap relative to upstart bitcoin.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.

Precious metals are at an interesting juncture. We can only go on Comex figures, representing perhaps 10% of total non-option derivatives. But if they are any guide, the firmer undertone, lowish volumes for gold and no increase in open interest signal classic bear squeeze conditions — the bears being predominantly the Swaps, three-quarters of which are bullion bank trading desks. These traders are running out of time ahead of the Basel 3 deadline in London only eleven weeks away.

On the last Commitment of Traders figures (12 October) bullion banks would have been net short about 117,000 contracts, out of the Swaps total net shorts of 159,774. That’s the equivalent of 364 tonnes of gold in paper form to be wound down. Our next chart shows the monetary value of the total swaps position — $41.8bn gross and $28.1bn net.

Turnover in the Comex silver contract was higher than that of gold, but again, open interest hardly changed on the week. This indicates book-squaring rather than new interest, and again can be taken as bullish.

Major base metals remain in backwardation, with copper’s particularly noticeable. It seems that commodities trader, Trafigura, has not only been particularly bullish, but has accumulated physical metal, draining LME inventories. Nickel has been hitting seven-year highs, and energy-intensive refining costs of steel, aluminium and cement are also having an impact., restricting supply.

Anecdotal information from China suggests that industrial production is being adversely hit by uneconomic input prices, including rising energy costs, as well as continuing logistics problems. There is lingering hope in some quarters that declining production will ease the rise in prices for industrial materials and raw materials.

That is all very well, and there is yet more global evidence of a developing slump in production. But analysts focusing on purely supply and demand factors are missing a bigger picture of the effect of increases in the supply of currency and credit on the dollar’s purchasing power. But economics, money and credit are not subjects widely understood, even in the investment and financial communities.

These communities are gradually awakening to inflationary problems. Increasingly they are quoting stagflation, which on further enquiry describes a condition they do not understand. But we can take it that this description is a waypoint on the route to a discovery that far from commodity prices rising, it is the purchasing power of fiat currencies falling.

Another step in this journey is the commentary about bitcoin’s revival, whose price hit a new high of $67,000 on Wednesday. JP Morgan’s analysts are quoted this morning’s Daily Telegraph as saying, “We believe the perception of bitcoin as a better inflation hedge than gold is the main reason for the current upswing… triggering a shift away from gold [funds] into bitcoin funds since September”.

This is consistent with an understanding of monetary affairs progressing as far as a relative supply argument between fiat and bitcoin, but a long way from reasoned analysis. Our final chart shows the ratio of gold to bitcoin.

Like trend-chasing amateur investors, JP Morgan’s clients are piling into something they half understand after the ratio has fallen from 5.00 to 0.03 (99.4%!), indicating that as inflation hedges established gold is incredibly cheap relative to upstart bitcoin.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.