Market Report: Break-Out Hopes Dashed

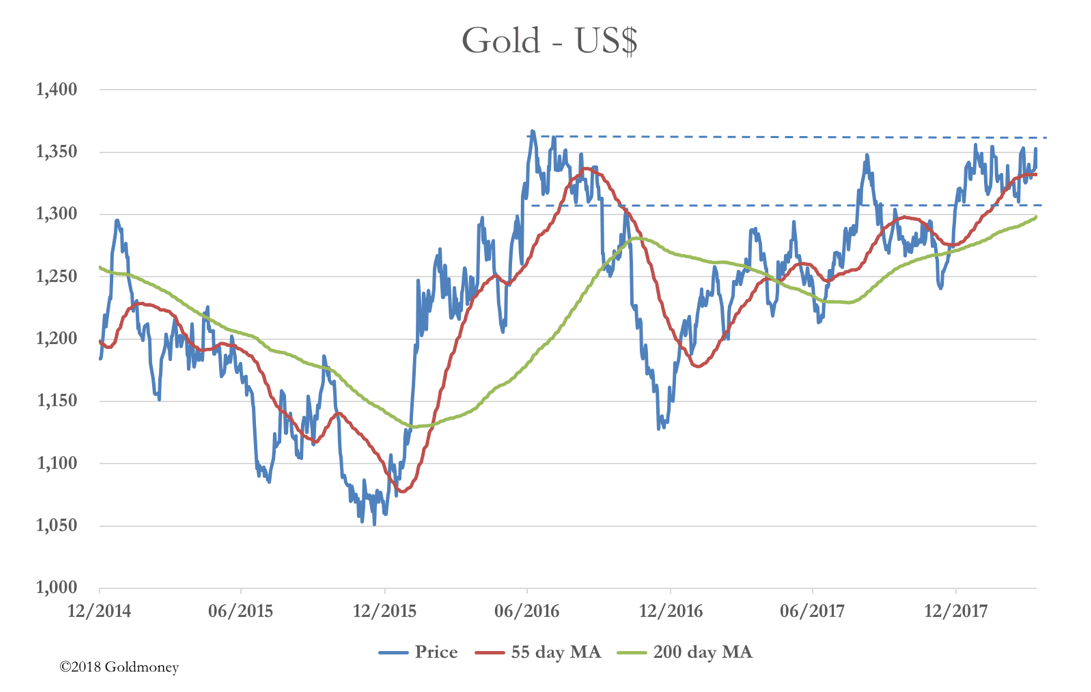

Apr 13, 2018·Alasdair MacleodAfter inching better on Monday and Tuesday, gold and silver finally made a break for it on Wednesday in good volume on Comex, with gold peaking at $1365 intraday, and silver at $16.87. Those of us watching gold’s established trading range, and silver’s extreme oversold position thought this could be the start of a major breakout to the upside. Those hopes were dashed on Thursday, when both metals retreated, giving up most of their gains on the week.

Gold ended up a net $8 on the week by mid-morning European trade at $1341 and silver a net $0.15 at $16.55.

President Trump, who only last week said he was withdrawing troops from Syria, changed his mind and is now planning to bomb the country. That may have been behind Wednesday’s spike in gold and silver, but in truth, the Syria story, and therefore market knowledge of the escalating risks associated with it, has been around all week.

On an event such as this, the market can justify either one of two diametrically opposed reactions: a flight to gold, or a flight to the dollar. Neither was much in evidence. The risk, of course, is that when attacking Syrian military assets, Russians are killed, provoking an escalating response between two super-powers. However, in an article in today’s Daily Telegraph, the Kremlin is reported to have said there is an active “hot line” between Russia and the US, being used by both sides. This being the case, it appears that the targets identified by the US will be cleared of Russian presence, and presumably some or all of Syria’s military assets as well before the cruise missiles start flying. Let’s hope so.

Meanwhile, the tension will build next week, and it is hard to see that it will be negative for gold and silver. Gold is back in its established trading range, and we shall have to wait a little longer before we can say the consolidation is over. This is illustrated on our next chart, which includes the moving averages favoured by technical analysts.

Silver’s oversold position is partially correcting, with open interest on Comex having retreated from the record highs of last week, since when 22,939 contracts, representing 114,695,000 ounces have been closed. 16,653 of these contracts have been “exchanged for physical”, and most of the rest have failed to be rolled over from May (which is winding down) into July, which is the next active contract. We will see the net effect on hedge fund short positions as of last Tuesday in tonight’s Commitment of Traders Report, released after hours.

Otherwise, while gold is in its trading range, and the dollar’s trade-weighted index holds up at the 89-91 level (this morning it is at 89.70), it is a waiting game. The key will probably be found in the dollar, which is our last chart.

The TW dollar is running into a well-established downtrend. It would appear that the sorter-term consolidation is more vulnerable to being breached, in which case another week or two should do it.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.