Living with contracting bank credit

Aug 25, 2022·Alasdair MacleodIn this article we look at the consequences of contracting bank credit on the economy, financial markets, and commodities. It is a developing global condition.

Why is bank credit on the verge of a substantial contraction? The starting point is record bank balance sheet leverage in the Eurozone and Japan, high bank leverage rates elsewhere, and a sea-change in the interest rate environment. In short, instead of being greedy for profits, senior bankers are now growing scared of risk and of their exposure to it.

The effect on the non-financial economy will be to cause nominal GDP to slump because every transaction that makes up GDP is settled through credit — nearly all of it is bank credit. Contracting bank credit will simply drive GDP into the ground.

But bank credit also drives financial activities, its long-term expansion having driven bond yields down, equities up, and expanding derivative markets to a $700 trillion monster. A credit contraction undermines financial asset values and associated derivative markets. This article looks at the inadequacies of Basel III regulations in this context.

Every ten years or so there is a banking crisis due to bankers attempting to reduce lending risk. Fourteen years since the Lehman failure, this cycle’s downturn is now overdue. The indications are that the cycle of bank credit contraction is just beginning…

Introduction

When Jamie Dimon spoke at a banking conference in New York and warned us that he was upgrading his economic outlook from stormy to hurricane conditions, we should have taken notice. It was probably the most important warning since Michael Burry shorted the 2007 mortgage bond market, and it came from not from an obscure trader, but the world’s most important commercial banker.

The subscript to Dimon’s warning is that he leads a US banking cohort which is increasingly concerned about escalating lending risks. It does not take a PhD in economics to understand that rising consumer, labour, and commodity prices result in higher interest rates. Nor does it take high levels of observation to understand the shock for a bank’s loan book.

It is too simplistic an argument to blame depressions, slumps, and recessions on the failings of the private sector. The cause is always a contraction of credit. But that is created by a previous overexpansion of bank credit and by its nature is a correction of a previous condition. The greater the expansion, the more destructive the contraction that follows.

Ignoring this reality, Keynes and others invested in a role for governments to intervene in economic affairs. It required the eventual abandonment of sound money. The original idea was for governments to take up the recessionary slack, stimulating the economy by deliberately running a budget deficit, and recovering public finances subsequently through increased tax revenues when the economy recovers. By these means, it was believed that recessions would be minimised, and government finances would be balanced over the cycle.

It was an argument which was applied with apparent success in the post-war years until the end of the Bretton Woods Agreement, when the inflation of the dollar M3 had doubled from $27bn in July 1950 to $59bn in August 1971, without apparent inflationary consequences.[i]

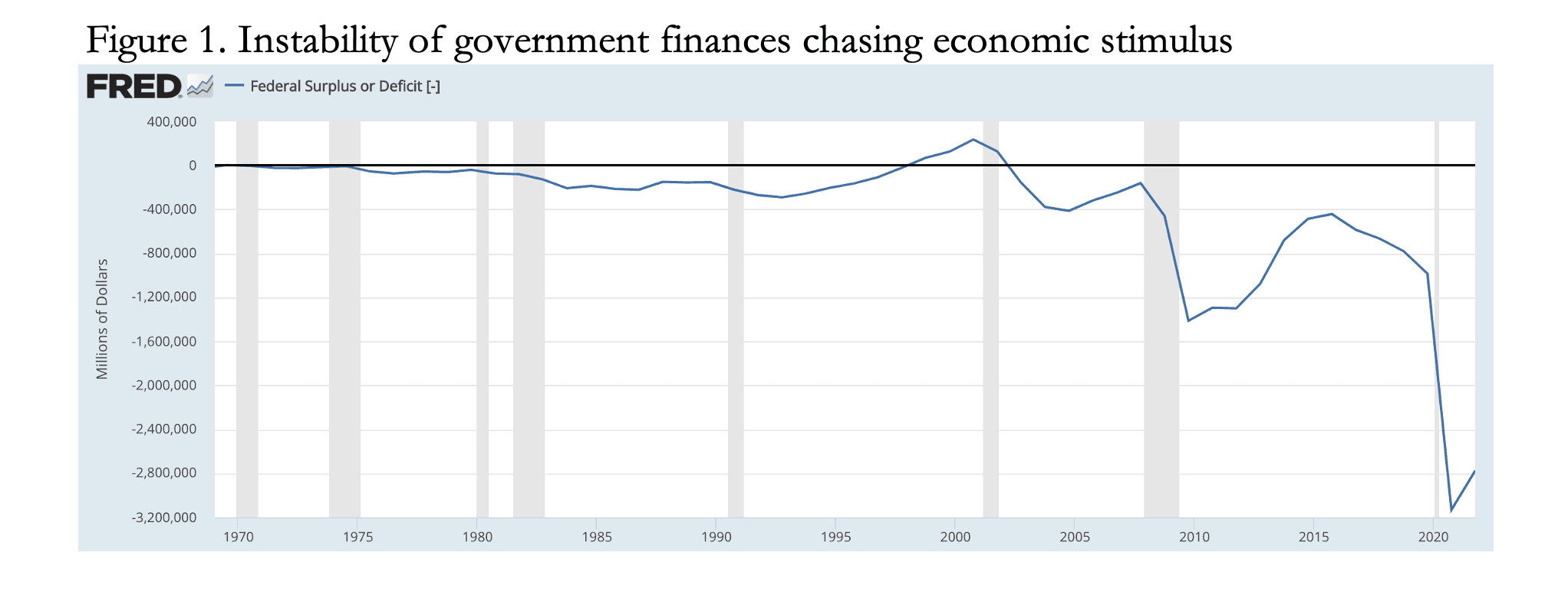

When the Bretton Woods agreement began to fall apart with the failure of the London gold pool in the late sixties, for America’s high priests of macroeconomics the strictures of a severely restricted gold standard were the problem, not the failures of their economic and monetary theories. Bretton Woods was abandoned, and ever since government-inspired economic theory has doubled down on failure. The FRED chart in Figure 1 of the US’s budget position illustrates the consequences of every time things go wrong, blame free markets and just double down on policy.

To put these deficits into context, in fiscal 2021, Federal Government outlays were $6.822 trillion, and revenues were $4.047 trillion. In other words, the revenue deficit on expenditure was 31.4% of it. The current fiscal year, which is ending shortly, is expected to see a partial recovery in revenue; but with President Biden spending like a sailor on shore leave and the prospect of a now widely expected recession, we can probably rule out any meaningful improvement in Federal Government finances.

Clearly, with recession expected despite stimulation from record government deficits, the Keynesian stimulation theory has run its course and has failed completely. But that is not all. Lower interest rates are meant to rouse an economy, and in that they have completely failed. In fact, so far are macroeconomics removed from economic reality that the whole establishment of the economic profession needs to reset their minds to reality: the reality which was better understood in what is now derisively termed classical economics. Which, of course is simply deemed to no longer apply.

One of the extraordinary failures of modern thinking concerns an almost total blindness to the cyclicality of bank lending. But Jamie Dimon’s warning of hurricane conditions is probably the best indication we can possibly have of a forthcoming cyclical contraction of bank credit. And what is nominal GDP, which is used to measure economic performance? It is no more nor no less than the deployment of credit for qualifying transactions making up GDP. Yet no one appears to understand the consequences of this important fact.

Yes, it is a fact. GDP rises and falls, not driven by consumers, but by changes in the availability of bank credit. Consumer behaviour is not the source of recessions in consumer activity; it is the availability of the credit that drives it.

The dissenting view

Those who do not understand the cycle of bank credit and its implications are the large majority of economic actors, both in the financial and non-financial sectors. The most stubborn cohort of numpties is to be found in government and its bureaucrats. From the major central banks to banking regulators, a group-thinking blindness to the causes of regular booms and busts is evident.

Unfortunately, if a government and its agents continue with wrong policies for long enough, instead of being derided, public belief in them grows. It is a particular problem in capital markets which have now bought into central bank monetary policies hook, line, and sinker.

Bank executives are not immune to this trend. Consequently, instead of understanding their business objectives properly, they are beholden to central banks and government regulators. Their true business is to be dealers in credit, not to bear responsibility for those who claim to be stakeholders but to achieve returns for their shareholders.

So far adrift have bankers’ objectives become, that looking at the relationship between equity book values and market capitalisations, we find that the Eurozone’s global systemically important banks’ capitalisations stand at an average discount to book value of nearly 60%. Not only are markets indicating that these banks are on course to fail, but that the executives of these banks are beholden to their respective regulators instead of their shareholders.

The Eurozone is not alone with this problem. By my calculations, China’s four G-SIBs average capitalisations stand at a discount to book of 55%, the UK’s three average 56%, and Japan’s three 52.5%. The eight US G-SIBs are not so blighted, with average capitalisations at 102% of book values, though Citi’s capitalisation appears to be at 50% of book.

For the purposes of understanding the cycle of bank credit, this probably results in a distortion. In pure terms, the cycle depends on phases of greed for profit and fear of losses and their consequences for shareholder returns.

Few bankers seem to realise that they are trapped in a cycle of bank credit of their own creation. That is why the cycle has existed for as long as credit statistics have been available. But combine a lack of understanding of the cause of the cycle with the absence of shareholder responsibility, and we can expect the management of large banks to think that with regulatory support they can trade their way out of economic downturns by simply adhering to the regulations.

The consequence is that when the crisis happens it will be least expected by large sections of the international banking community. We saw this ignorance displayed in the suddenness of the mortgage securitisation scandal in 2007—2008. It still applies today, only to a greater extent. It will not change the outcome, but it is a factor to bear in mind in the context of this article.

The starting point for credit contraction could hardly be worse

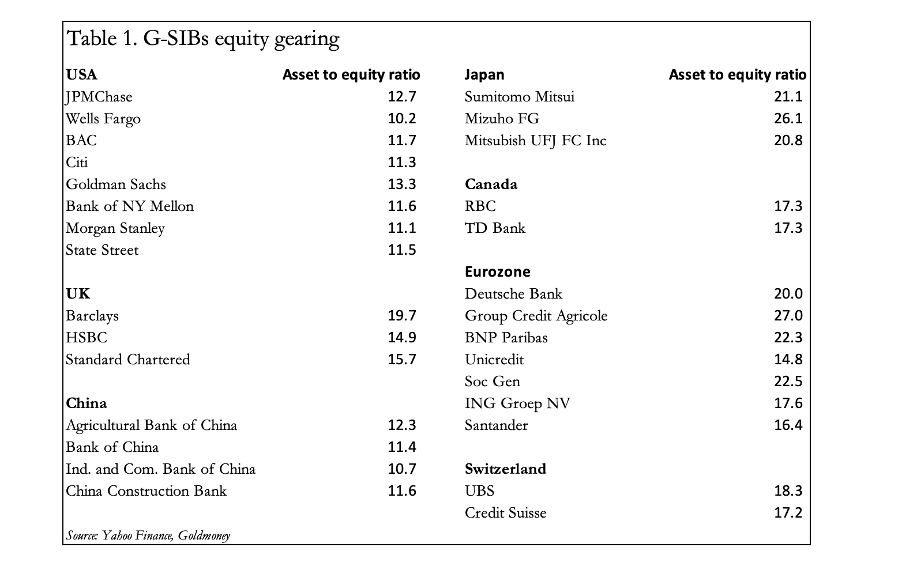

While interest rates were suppressed by central banks and official consumer price inflation remained at or close to the official 2% growth target, commercial banks were increasing their balance sheet leverage. This was most noticeable in banking systems where negative interest rates were imposed by central banks. In both the Eurozone and Japan, commercial banks geared themselves so that today global systemically important banks in both jurisdictions have asset to equity balance sheets ratios averaging over twenty times.

In the Bank of International’s Basel lll leverage ratio framework, the minimum ratio of capital, defined as the ratio of Tier 1 Capital Measure to the Exposure Measure, is 3%. Or to put balance sheet leverage more conventionally, 33.3 times. Admittedly, the Exposure Measure is more complex than total balance sheet assets. It includes certain off-balance sheet items and adjustments for credit risk. And importantly, there are special arrangements for derivatives, which allows for eligible bilateral netting contracts, and securities financing arrangements to allow for collateral held off-balance sheet.

Nevertheless, when historically bank balance sheet leverage of over ten times might have been deemed to be verging on risky, Basel III’s 33.3 times is beyond the pale. We all love gearing for profits when things are going well, but not when they are not. And this was the point behind Jamie Dimon’s hurricane warning. Incidentally, JPMorgan’s shareholder leverage appears to be about 12.7 times.

Bank credit, or customer deposits on the liability side of their balance sheets makes up the vast majority of circulating media. The only other element is cash and token coin. In the United States, officially bank credit makes up 88.3% of it, while bank notes and token coin are 12.7%. But of these dollar bills there are large quantities circulating abroad. According to the 2010 annual report of the Board of Governors, the Fed obtained $667bn in total seigniorage income from cash dollars held abroad, representing two thirds of currency in circulation at that time.[ii] However, estimates of dollar cash held abroad vary widely, but given the bulk shipments of dollar cash in support of US military actions and the general decline in cash usage domestically, as a proportion of circulating media we can probably assume bank notes represents less than 5% of the total credit behind GDP transactions, the rest being commercial bank credit.

Therefore, If US banks follow up on Jamie Dimon’s hurricane warning, it is clear that nominal GDP must contract severely. But this is also a global issue, with most non-US banks considerably more leveraged than those of the US. Just looking at the US’s eight global systemically important banks (the G-SIBs) we see an average asset to equity ratio of 11.7 times. For context, Table 1 shows estimated leverage ratios for all the world’s G-SIBs.

Sticking with the US for the moment, we would expect bank credit to contract to a more normal cyclical low of perhaps six to eight times equity. That implies a reduction of deposit liabilities amounting to between $7 and $10 trillion. Not all this will be reflected in GDP, since bank credit finances transactions in financial and capital assets as well. But nevertheless, normalising bank credit leverage can be expected to have a substantial impact on US GDP.

This is why understanding what GDP represents is so important. Financial analysts generally miss this point and seem to think the recession, which is increasingly evident, is driven by economic factors. They cite loss of consumer confidence and lack of human resources as well as supply chain issues hampering industrial output. These are not driving the recession; it is the availability of bank credit. The truth is that bank credit has just begun to contract and is bound to accelerate as bankers get more frightened about the interest rate outlook. Consequently, the slump is bound to become considerably more serious than is currently supposed.

The penultimate paragraph above points out that the forces driving a contraction of bank credit in the US are serious enough. But as Table 1 showed, the extremes of balance sheet leverage for non-US G-SIBs are considerably more alarming. In the Eurozone and Japan, where interest rates have been supressed into unnatural negative territory, G-SIBs have responded by increasing balance sheet leverage to maintain profitability. Now that global interest rates are rising, initially their profits are increasing. But so too are the risks that bad and doubtful debts will soon overwhelm them.

The euro system is riddled with bad debts and Japan is over-leveraged

On deeper analysis, we find that the entire euro system is rotten. For example, in 2016 Italian non-performing loans were 17% of total bank assets. By March, these had magically fallen to only 4% — a record low. But this is not due to some economic miracle; rather, it is due to the local banking regulator signing many loans off as performing, so that they were accepted as collateral for repos with the Italian central bank and then lost within the TARGET2 settlement system. An unquantifiable amount of the imbalances in the euro system of the ECB and the national central banks are due to this factor, being replicated in other Eurozone jurisdictions.

Most of these bad and doubtful debts probably still exist, supporting zombie corporations unable to weather higher interest rates. And now that the Eurozone is entering a recession which combines with soaring producer prices and globally higher interest rates, the situation can only deteriorate.

Outstanding Eurozone repos[iii] are estimated to have been €9,198bn in December 2021. Demand for high quality collateral to back repos has been the principal driver of demand for government debt, allowing banks to be paid to create liquidity, which in turn is invested in government bills and bonds for a small interest rate turn. The prevailing repo rates, which are still all negative, are shown in Figure 2.

As bond yields rise, the profits from borrowing cash through repos at negative rates to fund government debt on rising yields should ensure that Eurozone banks continue to buy short-term paper. With three-month Eurozone government bills typically yielding a positive 7 basis points, the return is about 0.2%. This works so long as alternative uses of balance sheet capacity is less attractive adjusted for risk, and so long as banks do not wish to contract their balance sheets. But, as argued above, the latter case is being challenged by the new interest rate environment. So, contraction of bank credit in the Eurozone will put an end to this repo roundabout.

The consequences for the funding of national government budget deficits are alarming. Without the ECB expanding its “asset purchasing programmes” to fund euro-area government deficits in their entirety, at a time when these deficits are also increasing materially the whole euro system will almost certainly face collapse. As they say, inflate or die.

Inflate or die also appears to apply to Japan’s financial and banking system. For Eurozone and Japanese banks with balance sheet leverage ratios of up to 27 and 26 times respectively, normalising their balance sheets for a higher interest rate environment is bound to lead to failures, spreading counterparty risks globally, including into the US banking system. This might explain the reluctance on the part of both central banks to raise interest rates, preferring to compromise their currencies rather than their financial systems.

And as the international settlement centre for commercial banks dealing in euros, dollars and yen, London is horribly exposed to both a global banking crisis and a currency one as well.

The impact of credit contraction on financial markets

Understanding that the nominal GDP statistic is driven by the availability of bank credit is only part of our story. Bank credit is also deployed in non-qualifying transactions, principally for capital items and financial assets. For the common man this probably means the availability for mortgage finance for his home, and we already see mortgage offers being withdrawn and greater value to loan margins being demanded, starting to undermine house prices.

Far more important in the wider economic context is the withdrawal of credit from the financing of transactions in financial assets. And here, we are not just contending with commercial banks withdrawing credit, but the consequences of a contraction in shadow banking as well. Estimates of the scale of shadow banking globally and in individual capital markets vary considerably, as do the extent of their operations. They can be defined as the financial intermediaries that conduct maturity, credit, and liquidity transformation operating without a banking licence.[iv]

Not all shadow banking involves credit creation, rather it is mainly credit transformation. The principal concern for us must be the extent to which shadow banks create unrecorded credit. This must refer principally to settlement delays from the moment of transaction, such as next day settlement, and derivative transactions between counterparties when one or both counterparties are non-banks and margin only is posted. Few people recognise them as credit, but any contract for future settlement is undoubtedly so.

[The treatment of derivatives for banks creating off-balance sheet liabilities in the form of unpaid commitments is addressed in Basel lll regulations – more on which below].

The point behind shadow banks is that they are an undefinable source of credit expansion in financial markets. But in many cases, they are no more than pass-throughs for bank credit. Figure 3, of broker loans in the US neatly illustrates this point.

There are two driving forces in margin loans’ decline: customers reducing their exposure to securities, and banks or brokers calling in or not renewing loans. In the initial stages of a bear market, it is credit being withheld, because those bullish enough to have leveraged their investments at the top of a bull market tend to be reluctant to sell. But while brokers are acting as shadow bankers, margin loan credit all originates from bank credit, the brokers simply acting as credit agents.

Besides indicating the relationship between banking and shadow banking, Figure 3 shows just one area where bank credit is already contracting, and it also illustrates a case where both forms of banking work in tandem. The lesson is that when the availability of bank credit for securities transactions contracts, so does the scale of shadow banking. Therefore, there is a heightened danger of a self-feeding fall in securities values as both bank credit and shadow bank credit are withdrawn from securities markets. Shadow bank credit created through the time lapse between transaction and settlement may also be threatened, leading to settlement failures on regulated exchanges. This poses a problem for dealings on the basis of margins deposited, where credit is effectively created for the unsettled balance in the expectation that the credit will be extinguished by a closing transaction.

Recently, the London Metal Exchange was forced to act in the nickel market when it became clear that there was going to be a credit failure. Bargains were cancelled to preserve the market. In a severe credit downturn, it is a potential problem for all regulated exchanges, with futures worldwide totalling some $40 trillion and a further $54 trillion in options.[v]

An additional concern is the background trend of rising interest rates, and how they will drive bond yields higher and equity prices lower. Since the financialisation of major economies in the 1980s such as those of the US, UK, and the EU, banks have increasingly shifted credit creation from supporting production to supporting financial activities. The change in the interest rate trend threatens to stop further application of bank credit to financial activities in its tracks.

Not only will banks be looking at collateralised loans, such as customers’ margin debt, but they will be looking at securities on their balance sheets as sources of funds to reduce their credit leverage. It is considerably less difficult to sell these assets than to initiate proceedings to recover loans from businesses and individuals.

An additional source of liquidity for reducing balance sheet leverage is cross-border claims and matching liabilities. According to the Bank for International Settlements, last March these claims by banks stood at $17.5 trillion, of which $8 trillion was in US dollars, $5.4 trillion equivalent in euros, $817bn in sterling, and $690 in yen.

The $8 trillion in dollars accords with the US Treasury’s TIC statistics, which showed that foreigners had claims last March on US banks for $7.07 trillion – the difference presumably reflecting Eurodollar balances held outside the Federal Reserve system. In a general credit contraction, foreign banks to whom these deposits represent balance sheet assets historically reduce foreign currency balances with their correspondent banks. And from the BIS’s numbers, we can see that the US banks and the dollar are most exposed to liquidation by foreign counterparties, followed by the euro, sterling, and yen.

OTC derivatives

By far the largest problem in a period of credit contraction is to be found in over-the-counter derivatives. These are unlisted contractual agreements between counterparties, including commodity contracts, credit default swaps, equity linked contracts, foreign exchange derivatives, and interest rate derivatives. According to the BIS’s database, in December 2021 the notional amounts outstanding of all contracts was $610 trillion. These positions are the total of seventy dealers’ returns in twelve jurisdictions, capturing an estimated 94% of the total covered in the BIS’s triannual survey, suggesting that the true total outstanding is closer to $650 trillion.

The majority of derivative dealers are divisions of commercial banks. As bank credit contraction intensifies, this raises two issues. The first is the counterparty consequences of a major bank failure which almost always happens at this stage of the credit cycle, and which must be prevented by ensuring that any bank with a derivative book is bailed. The second is the extent to which the banking cohort decides to reduce its exposure to OTC derivatives as a means of reducing balance sheet leverage.

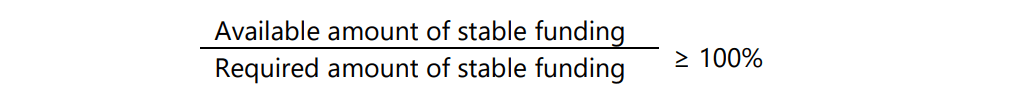

Let us assume for the moment that central banks move heaven and earth to prevent any significant banking failure. That leaves us considering the likelihood that banks will attempt to wind down derivative positions and the consequences. In this respect, bank treasury departments will be looking at Basel III regulations with respect to their net stable funding ratio (NSFR). The NSFR is calculated as follows:

In calculating Available Stable Funding for maintaining derivative positions (i.e., funding allocated from a balance sheet’s liabilities) a zero per cent allocation applies if derivative liabilities are greater than derivative assets. In other words, it is assumed that for funding net derivative liabilities, it is one of the least liquid activities a bank can engage in. And if derivative assets exceed derivative liabilities, the required amount of stable funding is 100%.[vi] Again, this is punitive in funding terms.

Therefore, whether a bank’s trading position is positive or not, derivatives are the least efficient activity from a funding point of view. The effect of the NSFR regulations will be to dampen down OTC derivative activity other than for balancing transactions. Positions will be run off as they mature, and new ones not opened. Therefore, markets will have to absorb a significant contraction of over $600 trillions-worth of OTC derivatives, and a further $100 trillions-worth of regulated futures and options.

The ability of banks, financial intermediaries, and businesses to offset risks in derivative markets are bound to be hampered, thereby leading to less trading liquidity. And any underlying trading inventory, comprised of long positions in bond and equity markets, will tend to be reduced, while short positions will be similarly affected or even closed down.

But the consequences for commodities will be entirely different. Banks and other dealers rarely hold any physical stock. If they do, such as in precious metals, it is never sufficient to cover potential liabilities.

For example, according to the BIS database for December 2021, the notional amounts of gold forwards and swaps stood at $686bn, the equivalent of 11,762 tonnes. These positions are almost exclusively those of LBMA members. We know that the vast majority of these forwards and swaps are extinguished by the AURUM settlement machine matching buyers and sellers, with only a small portion being settled by transfers between sellers and buyers within the London vaults. Given that the LBMA vaults contain bullion stored mostly for non-banks, the actual liquidity for AURUM imbalances is likely to be less than 500 tonnes. Indeed, AURUM is a highly efficient settlement machine, allowing the member banks of London Precious Metals Clearing Limited to carry as little physical inventory as possible.

Bear in mind, that for a bank to sit on non-yielding physical is always deemed an undesirable use of credit resources, and furthermore the Required Stable Funding factor for holding physical gold is a punitive 85%.

Essentially, demand for over 11,000 tonnes of gold is diverted into paper derivatives. Much of this will be reflected in unallocated bullion accounts offered by LBMA member banks to their customers. The extent to which contracting bank credit reduces the size of OTC derivatives will be reflected in their withdrawal of unallocated gold deposit account facilities. If they didn’t realise it before, these depositors will find that they have no rights to any physical gold.

The conditions that apply to gold also apply to all commodity dealing in derivatives and the physical. Therefore, the reduction of both OTC and regulated derivative markets in a general contraction of bank credit is set to lead to greater demand for physical replacements. It is bound to add to the current trend for rising commodity and precious metal prices relative to financial securities undermined by rising interest rates.

Further comments on Basel III’s NSFR

By treating derivatives on a net basis, Basel III’s net stable funding regime fails to reflect the real risks of open derivative positions. Net liability or asset balances are usually just a few per cent of the credit imputed in the individual derivatives.

Systemic risk from OTC derivatives is enhanced by the structure of the market. In any one category (swaps, commodities, options granted etc.) a bank’s trading desk is likely to have multiple positions with separate counterparties. The failure of any one counterparty will expose the bank to losses on the full amount of the OTC contracts with it. Furthermore, a single derivative position can have multiple counterparties, the failure of any of which can lead to a domino effect.

It was precisely to avoid an OTC crisis that Basel III was devised in the wake of the American Insurance Group failure in 2008. The New York Fed was forced to step in with an $85bn loan when this creator of derivatives, particularly of credit default swaps, ran into difficulties. Put simply, AIG’s management saw derivatives as an extension of insurance activities but failed to understand the true risks of the collateralised mortgage market. This failure gave regulators in all financial centres a bad fright, leading to the drafting of new banking regulations in Basel III to limit the impact of contract failures.

But by merely addressing the credit risk implied by mark-to-myth values of derivative positions on a net basis, Basel III fails to address the real risks in the gross values of a bank’s derivative obligations.

Conclusion

This article has addressed some of the obvious consequences of a radically different lending environment for banks. It commenced by making it clear that it is changes in the level of bank credit outstanding which drives economic statistics, not whether for some reason or another economic actors decide to change their levels of production and consumption. It is a point not properly understood by mainstream commentators, economists, and investors.

There’s no doubt that the global economy is entering a recession. Behind this development is the ending of a long-term interest rate downtrend, which in some cases led to negative interest rates. Banks increased their balance sheet leverages to extraordinary levels to maintain profits on slimed down credit margins, setting them up for a massive reversal, in the event of a change in interest rate trends. That change is now upon us, with previous currency and credit expansion fuelling ever-rising consumer prices, compounded by global factors carelessly brought upon us by government actions which have led to a life-threatening fuel and food crisis.

For bankers not captured by their regulators, fear of losses for shareholders is replacing greed. Rising interest rates are escalating loan risks, raising the cost of government debt finance, and forcing commercial banks to withdraw credit from Main Street.

Wall Street is also affected. Along with the long-term trend of declining interest rates, there has been a matching trend of falling bond yields and rising financial asset values. Since 1985, to which we can date the beginning of financialisation of global economies, we have seen total assets for all US banks increase tenfold. That is the trend being reversed.

The impact on GDP is bad enough. But there will also be fundamental changes for financial markets. Driven by rising interest rates and bond yields, the bear market is likely to be significant. And a severe contraction of credit following a prolonged expansion is bound to lead to bank failures — the empirical evidence is that it is inevitable.

The global weak points appear to be the Eurozone and Japan, where banks are most highly leveraged. While this article focuses on the effects of bank credit, a crisis in the Eurozone encompasses the euro system of the ECB and the national central banks, threatening the survival of the euro itself.

Even in the absence of bank failures, we have seen that banks will unwind their involvement in financial securities, including derivatives, adding to the bearish burden for markets, while at the same time removing the factors of artificial demand for commodities which have suppressed prices below what they would otherwise be.

When all the precariously placed fiat dominoes begin to topple, like latter-day John Laws central bankers are bound to sacrifice their currencies on the altars of saving financial markets, GDP, and the funding of rapidly deteriorating state finances. It is probably at that stage that the public will begin to abandon all hope for the purchasing power of their fiat currencies.

How do we stop this happening? We are probably too far gone down this inflation road to turn back. If that is the case, we will have to let the crisis happen in the hope that eventually the lesson will be learned: that unsound money and governments pretending they know how to improve on free markets are responsible for the greatest economic setback in recent history.

But don’t bank on it.

[i] See St Louis FRED, Currency in Circulation.

[ii] See page 5: The myth of the cashless society: How much of America’s currency is overseas? By Edgar Feige, published by the Bundesbank February 2012.

[iii] Repos — repurchase agreements, whereby a bank obtains liquidity by posting collateral on fixed terms.

[iv] Z. Pozsar, 2013. Shadow Banking, New York Fed.

[v] March 2022 — source, Bank for International settlements.

[vi] See Basel III: the net stable funding ratio Published by the Basel Committee on Banking Supervision, October 2014.