The Science of Gold & Precious Metals

Mar 2, 2014·Walt SosnowskiThere is frequent debate about the valuation of any asset or asset class.

Sometimes the debate is fierce, and few investment topics evoke as much passion and controversy as gold — especially among professional investors. Many believe that gold is useless as a commodity and are sceptical of its alleged monetary value. For those that have legitimate doubts about the value of gold, this paper is an attempt to address some of those doubts.

Precious metals have been reliably used as money for thousands of years. Over the course of many centuries, silver and gold served as the money of choice in major economies around the world. Why did this happen? Was it solely due to tradition — or are there compelling reasons why precious metals have been used as money? Over the next few pages, I will attempt to explain some of the science behind gold as money and as an investment. Many of the concepts also apply to the other precious metals — silver, platinum, and palladium. In order to keep this short, however, the focus will be on gold.

The Science of Precious Metals

Since most non-element commodities have shortcomings as money, the need for perfect uniformity and divisibility leads us to evaluate the elements for their utility as money. Therefore, let's review the periodic table. As you will recall from your high school or college chemistry class, here is the typical way that most of us are taught to think about all the different elements in the universe:

Couldn't any of the elements be used as money? Not really. Theoretically, any of the elements could serve as money. Practically, however, there are limitations on which elements can serve as money and which can't. The limitations are as follows:

It must be scarce: This eliminates most of the 100+ elements.

It must be a solid: While it is theoretically possible to have a gas or a liquid be money, it is not very practical.

It must not be harmful: Many of the elements are radioactive or toxic, which would preclude their use as money.

It must be durable: This eliminates many elements that are brittle or corrosive.

So which of the elements in the periodic table would be the best form of money? In order to answer that question, we need to first determine which elements are the most rare. So instead of grouping the elements by atomic number, we need to re-sort the elements from most abundant to least abundant. While there are some differences between various scientific studies on the subject, for the purposes of this analysis we will use the list found in the CRC Handbook of Chemistry and Physics, 92nd Edition 2011-2012. Please note that abundance is measured in parts per million. For details, please see Exhibit 2 on the next page.

You will notice that the precious metals are not the scarcest elements on the planet. If scarcity is so important, then why shouldn't one of the more scarce elements be a better form of money than gold or silver? As you can see from the exhibit below, 20 of the 24 rarest elements have problems that prevent them from being money. If an element is radioactive or toxic, then it is clearly removed from the competition. Liquids or gases are not very practical, so we can throw those out as well. We can also remove solids that are brittle, corrosive, or hard to work with.

After eliminating these 20 elements from consideration, that leaves just four elements: gold, silver, platinum, and palladium. These four are commonly referred to in the investment community as "precious metals."

Of the four precious metals, gold and silver have the longest history of monetary use. The reason for this is simple: platinum wasn't discovered until the 18th century, and palladium wasn't discovered until 1802. Plus, platinum and palladium are not prevalent throughout the world whereas gold and silver are found on every continent. So even though gold and silver are precious, they are both global metals, which is an important characteristic. Consequently, both gold and silver have been used as money for approximately 4,000 years of recorded history.

While silver, platinum, and palladium have some interesting monetary properties, for purposes of this analysis I am not going to provide additional detail on these metals. I will, however, provide some additional information about gold. In addition to not having negative properties like toxicity or radioactivity, gold has the following beneficial properties that make it attractive for monetary use:

• Most malleable of all metals. (Malleability is a material's ability to deform under compressive stress. This makes gold durable and easy to work with.)

• Most ductile of all metals. (Ductility is a material's ability to deform under tensile stress. This also makes gold durable and easy to work with.)

• Highly inert. (Gold is one of the eight "noble metals," which means it is highly resistant to corrosion. This is important for stability and durability.)

• Attractive. (Gold has a shiny, distinctive look compared to many of the other elements. This can be very helpful when you are trying to impress a woman or convince her to marry you.)

Comparison Summary

Now that we have gone through the science behind precious metals, let's return to our discussion of the different potential types of currencies — fiat currencies vs. physical currencies. In light of everything we've discussed, here is a summary table comparing some of the different options:

Performance History: Fiat Currencies vs. Gold

Many investors might argue that fiat currencies are a reliable store of value. Over short periods of time, that is correct. Over longer periods of time, though, fiat currencies are not reliable stores of value. Let’s examine data from the last 40 years. The year 1971 is a good starting point because that was the last year that the US dollar was still nominally backed by gold.

This first graph uses the US dollar as the constant or numeraire* from which to compare the performance of gold, the US dollar, and the British pound. To avoid distortions caused by a long time period, the chart uses a logarithmic scale, which I believe is a more conservative way to present the data.

As you can see, gold is up approximately 4,100% (41-fold) compared to the US dollar during the last 40 years. That is a compound annualised growth rate of 9.5%. Most investors are surprised to learn that gold appreciated by such a large amount in the last four decades.

There is a different way to analyse the same information. In the next chart, we will use gold as the constant or numeraire, and measure the other two against gold. Again, to avoid distortions caused by the long time period, a logarithmic chart is used.

Looking at it this way, you can see that the two fiat currencies have depreciated significantly against gold. The US dollar lost 97% of its value, and British pound lost 98% of its value. Please remember that the US dollar was one of the more trusted currencies in the world during the last five decades — and many other currencies didn’t even survive the entire 40-year period.

The above graphs aren’t perfect. They don’t take into consideration interest or taxes. Some might argue that fiat currencies could have been earning interest all those years, so the loss is overstated. That is partly true. If fiat currencies are loaned out, they earn interest, of course. But the same goes for gold and silver — they could have also earned interest if they were loaned out (the “interest” rate on gold is typically referred to as the “lease” rate). Also, in each case, taxes would have to be paid each year on any interest earned. But please don’t miss the main point: over long periods of time, even the good fiat currencies get diluted and lose value. Even more importantly, a bad fiat currency can lose its value quickly.

So why did the US dollar depreciate 97% compared to gold during the last 40 years? One of the main reasons is the supply of gold only grew approximately 1-2% per year during that period, thus the entire monetary base of gold was only diluted at 1-2% per year. Meanwhile, the supply of US dollars grew approximately 6-10% per year. More specifically, the monetary base grew 10%, M1 grew at 6%, and M2 grew at 7%. Thus, the holders of dollars were diluted at a much faster rate than holders of gold. Over short periods of time, this dilution may appear inconsequential. Over longer periods, however, the difference can become significant — especially during periods when central banks are rapidly expanding the monetary supply.

Addressing Some of the Common Criticisms of Gold

Despite gold’s significant out-performance vs. fiat currencies during the last 40 years, gold continues to have numerous critics. I believe it is worthwhile to listen to the arguments of those who question the value of precious metals. I also believe it is instructive to bring a fresh perspective to the debate.

The section below offers a different way to think about some of the common complaints.

Questions & Answers

question: Besides jewellery, isn’t gold useless?

answer: No. Gold has some very important uses. First, it is used as money, and the last time I checked, money was a very useful item. Gold is also used in making jewellery, of course. Finally, gold does have some important industrial uses, which account for approximately 15% of annual gold demand. So gold has three main uses — monetary use (money and investing), consumer use (jewellery), and industrial use (various).

question: Gold doesn’t pay interest. How do you address that issue?

answer: That statement is both true and false. If you don’t loan gold out, then it doesn’t pay interest. But if you do loan gold out, then it does pay interest. The same is true for US dollars or any currency for that matter. If you loan out dollars, they pay interest. But if you don’t loan out dollars, then they don’t earn interest.

question: OK. But isn’t the interest rate for gold lower than the interest rate for most fiat currencies?

answer: Yes, that is true. The interest rate for gold is typically lower — and for good reason. Most borrowers would rather borrow money that loses its value over time. Also, the banking laws and legal tender laws in many countries make it difficult or impossible for most gold owners to earn interest. Finally, some holders of gold are concerned about counterparty risk and prefer to hold their gold instead of lending it out. Thus, they are willing to forego loss of interest for the safety of reducing counterparty risk.

question: Gold is so old-fashioned. Do you really expect everyone to store their own gold and carry around gold coins to buy stuff?

answer: No. Gold can be held and transferred with all the benefits of modern technology. Gold is easily purchased and sold electronically.

question: Isn’t it difficult to value gold?

answer: Yes, it is. Valuing gold isn’t easy — but it can be done. There are numerous ways to quantitatively value gold. As with any currency or asset, different people will use different methods and come up with various answers. But that is true of nearly any currency or asset. By the way, it is also difficult to value the US dollar or any other currency. question: So how do you quantitatively value gold?

answer: There are a number of different ways. In order to go through all the details, that would take another 50+ pages. I wish I had the time now, but I don’t. In the meantime, here are a few of the different quantitative methods:

• QBAMCO’s Shadow Gold Price methodology, which uses the same formula as Bretton Woods.

• James Turk’s Gold Money Index, which uses the following formula: Central Bank Foreign Exchange Reserves Central Bank Gold Reserves

• The Federal Reserve Act of 1913 method, which used 40% backing of the currency.

• Various other percentages of US or global M0, M1, M2, or M3.

• As a percentage of US or global GDP.

• As a percentage of US or global net worth.

• As a percentage of US or global total credit market debt.

• Marginal cash cost of production methodology.

• Normalised total cost of production methodology.

Note: for some good details on some of these methodologies, you might want to read a 90-page report written by Erste Group Research entitled “Special Report Gold — July 2011.” Here is a link to the report: www.scribd.com/doc/59283769/Special-Report-GOLD-In-GOLD-We-TRUST- July-2011

Note: another interesting source is page 243 of a recently-published book by Jim Rickards entitled Currency Wars: The Making of the Next Global Crisis.

question: Using the above methodologies, what are the price targets for gold?

answer: The price targets for gold’s exchange rate vary from $2,500 to $12,000+ per ounce.

question: Many experts say gold is overvalued. What is your response?

answer: The next time someone claims gold is overvalued, please ask them to quantify their claim. Many people give plenty of qualitative arguments about why gold might be overvalued, but they rarely provide any quantitative explanation. I would be sceptical of qualitative-only arguments.

question: How high can the gold price go? answer: I prefer to start with a different question: “How low can the US dollar go?” I believe it is better to start with that question, because the debasement of the dollar and other fiat currencies is going to be one of the main drivers of the price of gold. Worldwide inventories of gold remain fairly constant, and an ounce of gold remains exactly constant. Meanwhile, the US dollar and other fiat currencies are being significantly diluted. If the dollar continues to lose a lot of its value, then the price of gold can go much higher.

question: Some people think there are large deflationary forces in the world. Doesn’t gold perform poorly during deflationary periods?

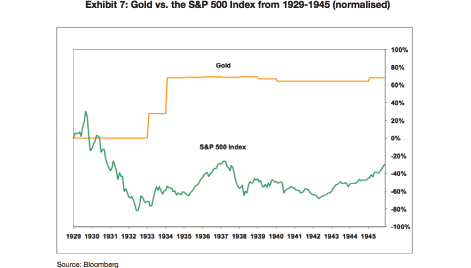

answer: No, not necessarily. I agree that there are large deflationary forces in the world, but during the two greatest deflationary periods in US history, gold performed quite nicely. During the Great Depression, gold actually rose 69% whereas most other assets dropped significantly in price. Additionally, during the 23-year deflationary period from 1873 to 1896, gold held its value while most other assets dropped in price. Below is a chart showing gold’s performance during the Great Depression:

question: Gold has had a terrific 11-year run. Have I missed it? Am I buying at the top?

answer: I don’t think so. Even after appreciating during the last 11 years, I believe gold is still undervalued and under-owned. It is significantly under-owned by mutual funds, hedge funds, pension funds, sovereign wealth funds, retail investors, and central banks. If gold comprised 5-10% of global portfolios, then I would be more worried. But gold only comprises approximately 1% of global portfolios. So there is plenty of additional buying that could send the price of gold higher.

question: Why isn’t there more scientific discussion about gold?

answer: Good question. While there hasn’t been much recent scientific discussion of precious metals, there is actually a long history of scientific analysis of money and gold going all the way back to Aristotle, who wrote about gold and money in his great work on political philosophy entitled Politics. In fact, one of the greatest scientists of all time — Sir Isaac Newton — spent 31 years of his career analysing precious metals and money. In addition to Newton’s numerous achievements in science, he became the Warden of the British Royal Mint in 1696. Then three years later in 1699, Newton became the Master of the Royal Mint, a position he held until his death in 1727.

question: How does fiat currency debasement happen, and why is gold immune to currency debasement?

answer: In the old days, governments and politicians would try to debase the currency by mixing in less precious metals into the coins, or by making the coins smaller and trying to pass them off for the same value. With the invention of fiat paper cur- rency, governments could just print more and thus devalue all of the currency in circulation. Today, they just create more electronically with the click of a mouse.

Meanwhile, unlike a fiat currency where the money supply can be increased by 5% or 10% with the click of a mouse, the supply of gold only increases by about 1% or 2% a year. In order to increase the supply of gold by 10% in one year, the world would have to build a huge number of new mines, which isn’t likely to happen. Hence, the supply of gold has some significant constraints, which prevents oversupply. This allows it to be a reliable store of value.

question: What would cause you to sell gold?

answer: I would sell gold when some combination of the following four things happens: First, if the US Federal Reserve were to raise the Fed Funds Rate to 10% similar to what Paul Volcker did in the early 1980s. (As you may recall, in that period the Fed Funds Rate averaged over 10% for nearly four years and even hit 20% on three occasions.) Second, if the Fed significantly reduced the size of its balance sheet. Third, if central bank balance sheets in Japan, Europe, and the United States stopped expanding so rapidly. And fourth, if gold were to become overvalued. As of this moment, however, none of the first three things are even close to happening. As for the fourth item, I believe that gold is undervalued, not overvalued.

Click here to view the entire Whitepaper as a PDF...

Legal Disclaimer

This commentary is for general informational purposes only. Nothing contained herein should be interpreted as a recommendation or opinion by SRC Capital Management, LLC (“SRC”) or any of its affiliates that you should make any purchase or sale of any security or participate in any transaction. This commentary does not constitute investment advice and is not an offer to sell or the solicitation of an offer to buy any securities or financial products. This commentary is neither an offer to sell nor a solicitation of any offer to buy interests or shares in any fund managed by SRC. The views contained herein are solely those of SRC and are subject to change without notice.

Accounts managed by SRC and its affiliates may hold, enter into and/or exit positions in certain of the securities and financial products discussed in this commentary. In particular, accounts managed by SRC currently hold and may from time to time hold positions in companies involved in the mining or ownership of gold, silver, and other precious metals.

Certain information contained herein has been obtained by SRC from third parties. SRC has not verified the accuracy of such information and shall not be liable for any errors in such information or for any actions taken in reliance thereon. SRC is not under any obligation to update or keep the information contained herein current.

These materials may contain forward-looking statements that are based on SRC’s experience and expectations about the markets in which SRC invests and operates. Forward-looking statements are sometimes indicated by words such as “anticipates,” “expects,” “believes,” “seeks,” “may,” “intends,” “plan,” “should,” “attempts,” “would,” “could,” “will” or the negative of these terms or other similar expressions. No reliance should be placed on such forward-looking statements as such statements speak only as of the date on which they are made. Forward-looking statements are not guarantees of future performance and are subject to many risks, uncertainties, and assumptions that are difficult to predict. Actual results may differ, and such differences may be significant. Past performance is not predictive of future results. The forward-looking statements contained in these materials are expressly qualified by this cautionary statement.

This document is confidential and intended solely for the addressee. No information or material contained herein may be reproduced, transmitted, displayed or commercially exploited without the prior written consent of SRC. All rights are reserved