The Arrival Of The Credit Crisis

Dec 27, 2018·Alasdair MacleodThose of us who closely follow the credit cycle should not be surprised by the current slide in equity markets. It was going to happen anyway. The timing had recently become apparent as well, and in early August I was able to write the following:

“The timing for the onset of the credit crisis looks like being any time from during the last quarter of 2018, only a few months away, to no later than mid-2019.” [i]

The crisis is arriving on cue and can be expected to evolve into something far nastier in the coming months. Corporate bond markets have seized up, giving us a signal it has indeed arrived. It is now time to consider how the credit crisis is likely to develop. It involves some guesswork, so we cannot do this with precision, but we can extrapolate from known basics to support some important conclusions.

If it was only down to America without further feed-back loops, we can now suggest the following developments are likely for the US economy. Warnings about an economic slowdown are persuading the Fed to soften monetary policy, a process recently set in motion and foreshadowed by US Treasury yields backing off. However, price inflation, which is being temporarily suppressed by falling oil prices, will probably begin to increase from Q2 in 2019. This is due to a combination of the legacy of earlier monetary expansion, and the consequences of President Trump’s tariffs on consumer prices.

After a brief pause, induced mainly by the threat of an unstoppable collapse in equity prices, the Fed will be forced to continue to raise interest rates to counter price inflation pressures, which will take the rise in the heavily suppressed CPI towards and then through 4%, probably by mid-year. The recent seizure in commercial bond markets and the withdrawal of bank lending for working capital purposes sets in motion a classic unwinding of malinvestments. Unemployment begins to rise sharply, and consumer confidence goes into reverse.

Equity prices continue to fall, as liquidity is drained from financial markets by worried investors, but price inflation remains stubbornly high. Consequently, bond prices continue to weaken under a lethal combination of foreign-owned dollars being sold, increasing budget deficits, and falling investor confidence in the future purchasing power of the dollar.

The US enters a severe recession, which is similar in character to the 1930-33 period. The notable difference is in an unbacked pure fiat dollar, which being comprised of swollen deposits[ii] (currently 67% of GDP versus 36% in 2007), triggers an attempted reversal of deposit accumulation. The purchasing power of the dollar declines, not least because over $4 trillion of these deposits are owned by foreigners through correspondent banks.

One bit of good news is the US banking system is better capitalised than during the last crisis and is unlikely to be taken by surprise as much it was by the Lehman crisis. Consequently, US banks are likely act more promptly and decisively to protect their capital, driving the non-financial economy into a slump more rapidly by calling in loans. Price inflation will not subside, because that requires sufficient contraction of credit to offset the declining preference for holding money relative to goods. Any credit contraction will be discouraged by the Fed, seeking to avert a deepening slump by following established monetary remedies.

The Fed’s room for manoeuvre will be severely restricted by rising price inflation, which it can only combat with higher interest rates. Higher interest rates will become a debt trap springing tightly shut on government finances, forcing the Fed to buy US Treasuries under cover of monetary stimulation. The true reason for QE will be that with a rapidly escalating budget deficit exceeding $1.5 trillion and more, the Fed will want to suppress borrowing costs compared with what the market will demand. Economic conditions will be diagnosed as a severe case of stagflation. In reality, the US will be ensnared in a debt trap from which the line of least resistance will be accelerating monetary inflation.

It will prove difficult for neo-Keynesian central bankers to understand the seeming contradiction that an economy can suffer a slump and escalating price inflation at the same time. It is, however, the condition of all monetary inflations and hyperinflations suffered by economies with unbacked fiat currencies. The choice will be to rewrite the textbooks, discarding current groupthink, or to soldier on. We can be certain the neo-Keynesians will soldier on, because they are intellectually unable to reform existing monetary policy in a manner acceptable to them.

That would be the likely outcome of the developing credit crisis if it wasn’t for external factors. There is precedent for it, and we can expect it from a purely theoretical analysis. It would be a rolling crisis, becoming progressively worse, taking six months to a year to unfold, followed by a period of economic recovery. But there is a major snag with this analysis for the US economy, and that is US monetary policy has long been coordinated with the monetary policies of other major central banks through forums such as the Bank for International settlements, G20 and G7 meetings.

The surprise election of President Trump upset this apple-cart with his untimely budget stimulus and the havoc he is wreaking on international trade. The result is the Fed is no longer on the same page as the other major central banks, particularly the Bank of Japan and the European Central Bank. Therefore, unlike crisis phases of previous credit cycles, the Eurozone enters it with negative interest rates, as does Japan, which are creating enormous currency and banking tensions. We will put Japan to one side in our search for knock-on systemic and economic effects triggered by the Fed’s increase in interest rates, and instead focus on the Eurozone, the heart of the European Union.

The Eurozone is irretrievably bust

It is easy to conclude the EU, and the Eurozone in particular, is a financial and systemic time-bomb waiting to happen. Most commentary has focused on problems that are routinely patched over, such as Greece, Italy, or the impending rescue of Deutsche Bank. This is a mistake. The European Central bank and the EU machine are adept in dealing with issues of this sort, mostly by brazening them out, while buying everything off. As Mario Draghi famously said, whatever it takes.

There is a precondition for this legerdemain to work. Money must continue to flow into the financial system faster than the demand for it expands, because the maintenance of asset values is the key. And the ECB has done just that, with negative deposit rates and its €2.5 trillion Asset Purchase Programme. That programme ends this month, making it the likely turning point, whereby it all starts to go wrong.

Most of the ECB’s money has been spent on government bonds for a secondary reason, and that is to ensure Eurozone governments remain in the euro-system. Profligate politicians in the Mediterranean nations are soon disabused of their desires to return to their old currencies. Just imagine the interest rates the Italians would have to pay in lira on their €2.85 trillion of government debt, given a private sector GDP tax base of only €840bn, just one third of that government debt.

It never takes newly-elected Italian politicians long to understand why they must remain in the euro system, and that the ECB will guarantee to keep interest rates significantly lower than they would otherwise be. Yet the ECB is now giving up its asset purchases, so won’t be buying Italian debt or any other for that matter. The rigging of the Eurozone’s sovereign debt market is at a turning point. The ending of this source of finance for the PIGS[iii] is a very serious matter indeed.

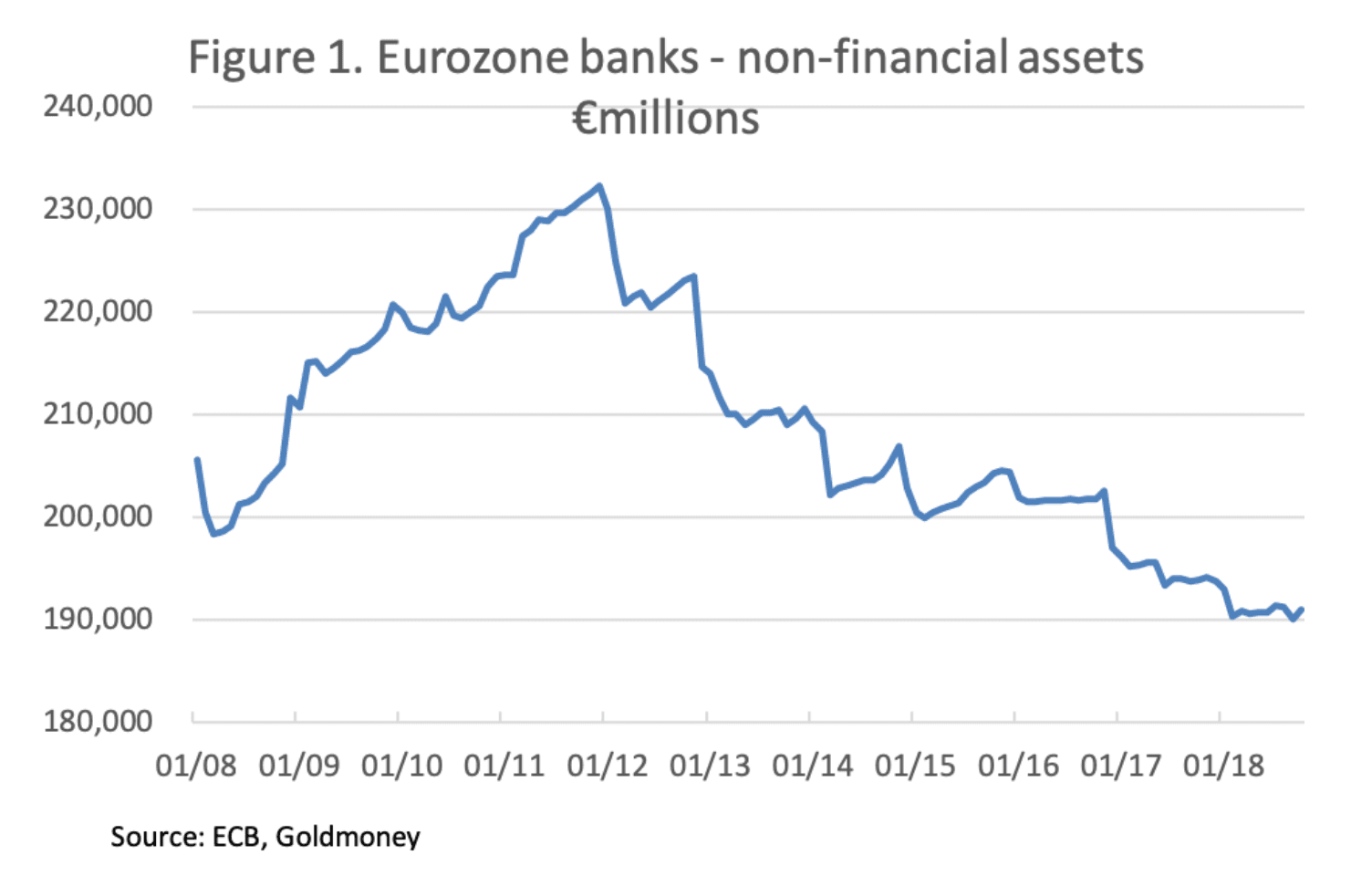

A side effect of the ECB’s asset purchase programme has been the reduction of Eurozone bank lending to the private sector, which has been crowded out by the focus on government debt. This is illustrated in the following chart.

Following the Lehman crisis, the banks were forced to increase their lending to private sector companies, whose cash flow had taken a bad hit. Early in 2012 this began to reverse, and today total non-financial bank assets are even lower than they were in the aftermath of the Lehman crisis. Regulatory pressure is a large part of the reason for this trend, because under the EU’s version of the Basel Committee rules, government debt in euros does not require a risk weighting, while commercial debt does.[iv] So our first danger sign is the Eurozone banking system has ensured that banks load up on government debt at the expense of non-financial commercial borrowers.

The fact that banks are not serving the private sector helps explain why the Eurozone’s nominal GDP has stagnated, declining by 12% in the six largest Eurozone economies over the ten years to 2017. Meanwhile, the Eurozone’s M3 money increased by 39.2%. With both the ECB’s asset purchasing programmes and the application of new commercial bank credit bypassing the real economy, it is hardly surprising that interest rates are now out of line with those of the US, whose economy has returned to full employment under strong fiscal stimulus. The result has been banks can borrow in the euro LIBOR market at negative rates, sell euros for dollars and invest in US Government Treasury Bills for a round trip gain of between 25%-30% when geared up on a bank’s base capital.

The ECB’s monetary policy has been to ignore this interest rate arbitrage in order to support an extreme overvaluation in the whole gamut of euro-denominated bonds. It cannot go on for ever. Fortunately for Mario Draghi, the pressure to change tack has lessened slightly as signs of a US economic slowdown appear to be increasing, and with it, further dollar interest rate rises deferred.

TARGET2

Our second danger sign is the massive TARGET2 interbank imbalances, which have not mattered so long as everyone has faith that it does not matter. This faith is the glue that holds a disparate group of national central banks together. Again, it comes down to the maintenance of asset values, because even though assets are not formally designated as collateral, their values underwrite confidence in the TARGET2 system.

Massive imbalances have accumulated between the intra-regional central banks, as shown in our next chart, starting from the time of the Lehman crisis.

Germany’s Bundesbank, at just under €900bn is due the most, and Italy, at just under €490bn owes the most. These imbalances reflect accumulating trade imbalances between member states and non-trade movements of capital, reflecting capital flight. Additionally, imbalances arise when the ECB instructs a regional central bank to purchase bonds issued by its government and local corporate entities. This accounts for a TARGET2 deficit of €251bn at the ECB, and surpluses to balance this deficit are spread round the regional central banks. This offsets other deficits, so the Bank of Italy owes more to the other regional banks than the €490bn headline suggests.

Trust in the system is crucial for the regional central banks owed money, principally Germany, Luxembourg, Netherlands and Finland. If there is a general deterioration in Eurozone collateral values, then TARGET2 imbalances will begin to matter to these creditors.

Eurozone banks

Commercial banks in the Eurozone face a number of problems. The best way of illustrating them is by way of a brief list:

- Share prices of systemically important banks have performed badly following the Lehman crisis. In Germany, Commerzbank and Deutsche Bank have fallen 85% from their post-Lehman highs, Santander in Spain by 66%, and Unicredit in Italy by 88%. Share prices in the banking sector are usually a reliable barometer of systemic risks.

- The principal function of a Eurozone bank has always been to ensure its respective national government’s debt requirement is financed. This has become a particularly acute systemic problem in the PIGS.

- Basel II and upcoming Basel III regulations do not require banks to take a risk haircut on government debt, thereby encouraging them to overweight government debt on their balance sheets, and underweight equivalent corporate debt. Banks no longer serve the private sector, except reluctantly.

- Eurozone banks tend to have higher balance sheet gearing than those in other jurisdictions. A relatively small fall in government bond prices puts some of them at immediate risk, and if bond prices decline it is the weakest banks that will bring down the whole banking system.

- Eurozone banks are connected to the global banking system through interbank exposure and derivative markets, so systemic risks in the Eurozone are transmitted to other banking systems.

The ECB itself is a risk

As stated above, the ECB through its various asset purchase programmes has caused the accumulation of some €2.5 trillion of debt, mostly in government bonds. The euro system’s central banks now have a balance sheet total of €4.64 trillion, for which the ECB is the ringmaster. Most of this debt is parked on the NCBs’ balance sheets, reflected in the TARGET2 imbalances.

The ECB’s subscribed equity capital is €7.74bn and its own balance sheet total is €414bn.[v] This gives an operational gearing on core capital of 53 times. Securities held for monetary purposes (the portion of government debt purchased under various asset purchase programmes shown on the balance sheet) is shown at €231bn (it will have increased further in the current year). This means a fall in the value of these securities of only 3% will wipe out all the ECB’s capital.

If the ECB is to avoid an embarrassing recapitalisation when, as now seems certain, bond yields rise, it must continue to rig euro bond markets. Therefore, the reintroduction of its asset purchase programmes to stop bond yields rising becomes the last fling of the dice. The debt trap Eurozone governments find themselves in has also become a trap for the ECB.

Conclusion

We can see that the global credit crisis has now been triggered. It always happens at some point anyway. The proximate triggers have been non-monetary, being the combination of President Trump’s fiscal reflation late in the credit cycle, and his imposition of tariffs on imported goods. The weakening of other economies from Trump’s tariff war is an additional factor undermining the global economic outlook.

Given these fiscal developments, the Fed had no option but to seek to urgently normalise interest rates, bringing on the credit crisis.

Inaction by the Fed would have undoubtedly seen price inflation accelerate, even allowing for the confines of a heavily suppressed consumer price index. The slowing of the US economy has, at least for the short-term, reduced price inflation factors. But as argued in this article they are unlikely to last.

These monetary developments have come at a time when two important central banks, the ECB and the Bank of Japan, are still applying negative interest rates. The disparity between these policies and that of the Fed, besides creating monetary and currency strains, will almost certainly lead to them both revising monetary policies. Only this month, quantitative easing in the Eurozone ceases, and bond prices are likely to fall significantly without it. A rise in the ECB’s deposit rate from minus 0.4% will surely follow, and it is hard to see how a developing systemic crisis in the region can then be prevented.

Since the Lehman crisis, inflation has been mostly bottled up in the financial sector, while being statistically suppressed in the productive economy. That is now about to change, leading to excess deposits at the banks trying to escape the consequences of their deployment for mainly financial speculation. It will not provide a boost in consumption, because consumers are maxed out and unemployment is rising. It will simply undermine the purchasing power of an increasingly unwanted, unbacked fiat currency.

[i] See https://www.goldmoney.com/research/goldmoney-insights/end-of-credit-cycle-dynamics

[ii] The sum of cash, checking accounts and savings deposits

[iii] Portugal, Italy, Greece and Spain.

[iv] See https://www.globalbankingandfinance.com/sovereign-risk-weights-the-big-missing-piece-of-basel-iii/

[v] ECB Annual Report and Accounts, 2017.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.