Gold prices reflect a shift in paradigm - Part II

Mar 16, 2023·Goldmoney StaffIn the first part of this report, we highlighted that observed gold prices have significantly detached from our model-predicted prices. While this has happened in the past, prices always converged eventually. However, the delta between the observed and the model predicted price has now reached a record high of around $400/ozt. We thus ask ourselves whether it is reasonable to expect that model-predicted and observed prices will converge again in the future, or, whether we witness a shift in paradigm and the model no longer works.

In our view, the only reason for gold prices to sustainably detach from the underlying variables in our gold price model is if central banks (particularly the Fed) lose control over the monetary environment. Thus, it seems that the gold market is now pricing in a significant risk that the Fed can’t get inflation back under control. As we highlighted in Part I of this report (Gold prices reflect a shift in paradigm – Part I, 15 March, 2023), this is happening in the most unlikely of all environments. The Fed has aggressively hiked rates at the fastest pace in over 50 years and it is signaling to the market that it will do whatever it takes to get inflation under control. So why is the gold market still concerned about inflation?

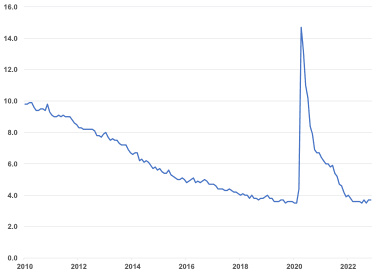

The issue is that so far, it has been easy for the Fed to raise rates sharply to combat inflation. Despite the sharp move in the Fed Funds rate, one may get the impression that nothing has happened yet that would jeopardize the Fed’s ability to raise rates even higher. For starters, the unemployment rate remains stubbornly low (see Exhibit 8).

Exhibit 8: The US unemployment rate remains stubbornly low despite the sharp rate hikes

%

Source: FRED, Goldmoney Research

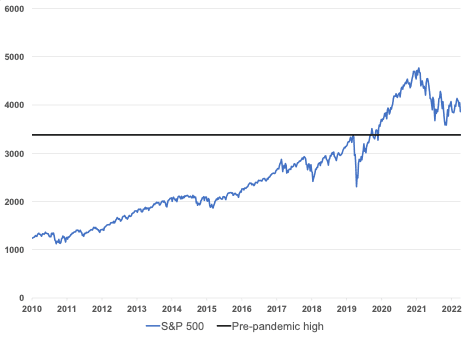

Equity and bond prices have sharply corrected in the early phases of the Fed’s rate hike cycle, but since then equity markets have partially recovered their losses. While equity prices are not the real economy, large downward corrections can impact the real economy nevertheless due to the wealth effect. When people become less wealthy, they spend less, which in turn has an effect on the economy. The impact of this reduction in wealth might also not be meaningful so far as the correction came from extremely inflated levels. The S&P 500, for example, has corrected almost 20% from its peak, but it is still 14% higher than the pre-pandemic highs in 2019 (see Exhibit 9).

Exhibit 9: Even though US equity prices have corrected sharply, they are still well above the pre-pandemic highs….

S&P 500 index

Source: S&P, Goldmoney Research

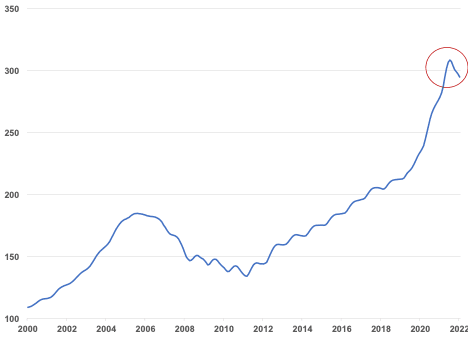

The real estate market has slowed down significantly, but so far prices haven’t crashed (see Exhibit 10), and even though there are a lot of early warning signs, the Fed historically had only become concerned when a crumbling housing market started to affect the banks. While we certainly saw turmoil in the banking sector over the last few days, it was not related to the mortgage business so far.

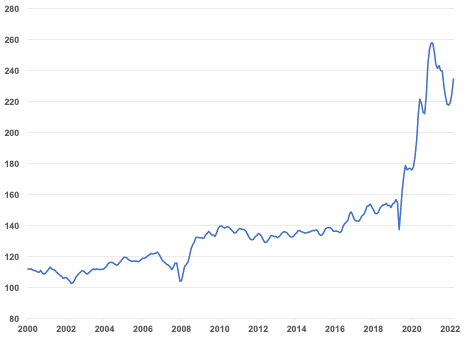

Exhibit 10: …and home prices – despite the clear rollover – have not crashed yet

Case Shiller US National Home Price Index, NSA

Source: S&P, Goldmoney Research

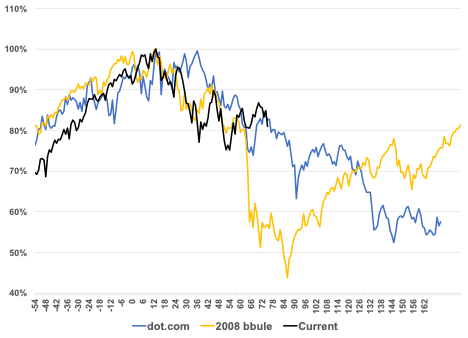

Hence, at first sight, it appears there is little reason for the gold market to price in a scenario where the Fed loses control over inflation. However, there are plenty of warning signs that things are about to change. In our view, the correction in the equity market is far from over. When the last two bubbles deflated, equities corrected a lot lower for longer (see Exhibit 11).

Exhibit 11: the last two bubbles saw much larger corrections in equity prices

% change S&P500 index (y-axis), weeks from the peak (x-axis)

Source: S&P, Goldmoney Research

This alone will start to put a strain on the disposable income of not just American consumers, but globally. We are seeing signs of this in all kinds of markets. For example, used car prices had skyrocketed until about a year ago on the back of supply chain issues combined with excess disposable income. But since the Fed started raising rates, used car prices have retreated somewhat (see Exhibit 12). Arguably this is good for people wanting to buy a car with cash, and it will also have a dampening effect on inflation numbers, but the reason for it is not that all the sudden a lot more cars are being produced, but that higher rates make it more expensive to finance cars, and thus demand is weakening.

Exhibit 12: Manheim used car index

Source: Bloomberg, Goldmoney Research

Certain aspects of the housing market also show more signs of stress than the correction in real estate prices alone suggests. For example, lumber prices have completely crashed from their spectacular all-time highs and are now back to pre-pandemic levels (see Exhibit 13).

Exhibit 13: Lumber prices have come back to earth

Source: Goldmoney Research

Similar to the development in the used car market, while this may be good for people trying to build a new home, it is indicative of the material slowdown in construction activity. This can be directly observed in housing data. New housing starts are 28% lower than in spring 2022 (See Exhibit 14).

Exhibit 14: New Housing Start data shows a material slowdown in construction activity

Thousands of units

Source: FRED, Goldmoney Research

Moreover, mortgage costs have exploded. A 10-year fixed mortgage went from 2.5% a year ago to 6.3% now (see Exhibit 15). This will undoubtedly dampen the appetite for home purchases and strain disposable income as previously fixed mortgages must be rolled over. Given current mortgage rates, it is surprising that the housing market has not yet corrected a lot more.

Exhibit 15: Mortgage rates have exploded over the past 12 months

%

Source: Bankrate.com, Goldmoney Research

There is a myriad of other indicators, from crashing freight rates (see Exhibit 16) to layoffs in the trucking and technology sector as well as languishing oil prices despite record outages and inventories, that indicate that the Feds (and increasingly other central banks) ultra-hawkish policy is impacting the real economy, both domestic and globally.

Exhibit 16: Freight rates had skyrocketed in the aftermath of the Covid19 Pandemic but are now back to normal

Container freight, USD/40ft box, Shanghai to LA

Source: Goldmoney Research

The result will be a period of global economic contraction. The Fed may view this decline in inflation as confirmation that their policies are working to fight inflation, even though it will only reflect a crashing economy. Importantly, once the recession kicks in, we will soon see rising unemployment. Once unemployment starts rising, the Fed will have to slow down its rate hikes and eventually stop. However, the underlying cause of inflation – over 8 trillion in asset buying by the Fed – will only have reversed a tiny bit by that point. This means that once the fed will have to make a decision, to either fight unemployment or inflation.

We believe that the most likely explanation for the recent rally in gold prices against the underlying drivers of our model is that the market is increasingly pricing in that the Fed, once it is forced to stop hiking, will lose control over inflation. Faced with the choices of years of high unemployment and a crumbling economy or persistent high inflation, the gold market thinks the Fed will opt for the latter. This would mark a true paradigm shift, and from that point on, gold prices may start to price in prolonged high inflation (and our model may not be able to capture this properly).

The crash of Silicon Valley Bank (SVB) a few days ago has created significant turmoil in financial markets. While the Fed jumped in and announced a new lending program that effectively bailed out the bank, it also led to a sharp change in market expectations for the Fed. Before the bailout, Fed fund futures implied that the market expected several more Fed hikes this year, and only a gradual easing thereafter. One week later and the market is now pricing in that the Fed will only hike until May, and then pivot and start cutting rates (see Exhibit 17).

Exhibit 17: The crash and subsequent bailout of SBV led to a sharp reassessment of the Fed’s ability to raise rates

Implied rates Fed funds futures, %

Source: Goldmoney Research

The gold market is still pricing in a much more dire outlook with higher and persistent long-term inflation Only time will tell whether this view is correct. In our opinion, it is quite forward-looking, and gold seems to be the only market that is that forward-looking at the moment. 10-year implied inflation in TIPS, for example, is at a laughably low 2.2%. For the model-predicted prices to match observed gold prices, 10-year implied inflation would have to be around 1.5% higher, at 3.75%. This doesn’t seem to be completely unfeasible. However, even if the gold market turns out to be ultimately correct, it will take a while until the rest of the market agrees with that view, and most likely there will be a period of sharply declining realized inflation in the meantime. That said, as equities look even more fragile in this scenario, and bonds and cash are unpopular asset classes during periods of high inflation, gold may simply be the only game in town until its time as the ultimate inflation hedge is coming.