Challenges for the new Prime Minister

Jul 28, 2022·Alasdair MacleodBritain’s next Prime Minister must address two overriding problems: London is at the centre of an evolving financial and currency crisis brought forward by a change in interest rate trends; and the reality of emerging Asian superpowers must be accommodated instead of attacked.

This article starts by examining the economic challenges the next Prime Minister faces domestically. Are the two candidates equipped with a strategy to improve the nation’s economic prospects, and why can we expect them to succeed where others have failed?

It is unlikely that either candidate is aware that there has been a fundamental shift in the direction of interest rates, the consequences of which are undermining debt mountains everywhere. The problem is particularly acute for the euro system. As well as for other major currencies, London operates as the clearing centre for transactions between the Eurozone’s commercial banks. If the euro system fails, London’s survival as a financial centre could be jeopardised.

The other major challenge is geopolitical. Being tied into America’s five-eyes intelligence network, coupled with policies to remove fossil fuels as sources of energy Britain is condemned to falling behind the Asian superpowers, and sacrificing trading relationships with which her true interests must surely lie.

And then there were two…

The selection process for a new Conservative Prime Minister has whittled it down to two — Rishi Sunak and Liz Truss. The former is a wealthy meritocrat, former Goldman Sachs employee and hedge fund manager, the latter a self-made woman. Sunak was Chancellor (finance minister). Among several other high-office roles, Truss has been First Secretary to the Treasury. Both, in theory at least, should understand government finances. Both studied PPE at Oxford, so are certain to have been immersed in the Keynesian version of economics, which also informs Treasury thinking.

Despite their common Treasury experience and being on that same page, Sunak’s and Truss’s pitches on economic affairs have been very different. Sunak aims to maintain a balanced budget, reducing taxes afterwards as economic growth increases tax revenues. This is Treasury orthodoxy. Truss is claiming she will cut taxes more immediately in an emergency budget to stimulate growth. She is emulating the Thatcher/Reagan supply-side playbook.

The politics are straightforward. The electorate is comprised of about 160,000 paid up Conservative Party members, mostly leaning towards less government, free markets, and lower taxes. As a subset of over 40,000,000 voters nationwide, they may be reasonably representative of a silent majority in the middle classes which believe in conservative societal values.

The one issue that matters above all for Conservative Party members is taxes. Given their different stances on tax, Truss has emerged as the early favourite. Furthermore, to the disadvantage of Sunak very few Chancellors make it to Prime Minister for a reason: like Sunak, they nearly always push the Treasury line on maintaining balanced budgets over the cycle, which means that they are for ever trying to pluck the goose for more tax with the minimum of hissing. Don’t expect geese to willingly vote for yet more exfoliation.

The issue of less government in the total economy is not properly addressed by either candidate or is restricted to vague promises to do something about unnecessary bureaucracy. In arguing for free markets, Truss is stronger in this respect than Sunak who appears to be more captured by the permanent establishment.

With the exception of Treasury ministers, all politicians in office are naturally inclined to seek increased departmental budgets, which is a problem for all tax cutters. But to understand the practical difficulties of reducing government spending, we must make a distinction between departmental expenditure limits and annually managed expenditure. The former is budgeted for by the Treasury in its allocation of financial resources. The latter can be regarded as including additional costs arising from public demand for departmental services. This explains why total departmental expenditure for fiscal 2020-21 was £566.2bn, representing about half of total government spending of £1,112bn.

With government spending split 50/50 overall on departmental expenditure limits and public demands for services, both issues must be addressed when reducing costs meaningfully. Failing to do so means only departmental expenditure limits are tackled, resulting in less resources to deliver mandated public services. That would be seen by the opposition and the public to be a government failing. Therefore, it is not sufficient to merely say to ministers that they must cut departmental expenditure, but laws and regulations must also be changed to reduce public service obligations as well. That takes time.

Imagine tackling this problem with respect to the National Health Service. The NHS takes 34% of total departmental expenditure limits, yet it clearly fails to efficiently provide the public with the services required of it. Health ministers always argue that it needs more financial resources. This is followed by education (13% of total departmental expenditure). What do you do: sack teachers? And Scotland at 8% is another no-go area, where cuts would likely encourage the nationalist movement. And that is followed to a similar extent by defence spending at a time of a proxy war against Russia…

One could go on about other ministry spending and the costly provision of their services, but it should be apparent that any realistic cuts in public services are likely to be minor and overwhelmed by rising and unbudgeted departmental input costs which are indirectly the consequence of the Bank of England’s monetary policies. It is therefore hardly surprising that neither Sunak nor Truss is seriously engaged with the subject of reducing state spending, merely fluffing around the topic.

But total state spending is going to be an overriding problem for the future PM. Figure 1 shows the long-term trend of total managed expenditure relative to GDP, admittedly exacerbated by covid. Since then, there has been a recovery in GDP to £2,239bn in the four quarters to Q1 2022, and covid related disbursements have materially declined, so that in the last fiscal year, total government spending is estimated to have dropped to 46.5% of GDP from the high point of 51.9%.

However, rising interest rates globally are set to drive the UK economy into recession. Even if the recession is mild, while GDP falls this will increase public spending on day-to-day public services back up to over 50% of GDP.

The philosophical problem for the new PM can be summed up thus: with half the economy being unproductive and the productive economy shouldering the burden, how can economic resources be restored to producers in a deteriorating economic outlook?

Inflation is not going away

Orthodox neo-Keynesians in the government and its (supposedly) independent Office for Budget Responsibility do not recognise that the root of the inflation problem is the debasement of currency and credit. Furthermore, by thinking it is a short-term supply chain problem, or a temporary energy price spike due to sanctions against Russia, the OBR, in common with the Bank of England takes the view that consumer price rises will return to the targeted 2% level. Only, it might take a little longer than originally thought.

Figure 2 shows the OBR’s latest forecasts (in March) for inflation (panel 1) and real GDP (panel 2).

Note how the October forecast failed to reflect an annual CPI rising to more than 4%. In March that was raised to 8%, which is already outdated. Price inflation rising to over 10% is on the cards, and it should be noted that the retail price index, abandoned by government because of the cost of using it for indexation, already shows annual consumer inflation to be rising at 11.8%.

The OBR’s response to these unwelcome developments is simply to push out an expected return to the 2% inflation target a little more into the future. Similarly, it expects the trajectory of GDP growth will be maintained, having just slipped a little.

On this evidence, the OBR’s advice to a future prime minister and his chancellor will be badly flawed. Instead of going down the macroeconomic approach of modelling the economy, instead we need to apply sound, unbiased economic and monetary theories.

We know that the Bank of England’s monetary policies have debased the currency, reflected inevitably in a falling purchasing power for the pound. That is what drives the increase in the general level of prices. The primary cause is not, as government and central bank officials have stated, supply chain disruptions and the consequences of the war in Ukraine. That has only made things worse, in the sense that higher energy and commodity prices along with supply bottlenecks have encouraged the average citizen to adjust the ratio of personal liquidity to purchases of goods and services, bringing forward purchases and driving prices even higher. The debasement of fiat currencies everywhere is encouraging their users to dump them in what appears to be a slowly evolving crack-up boom encouraged by a background of product shortages.

The common view that consumer price inflation is a temporary phenomenon is little more than wishful thinking, as is the latest argument developing, that rising interest rates will deflate economic demand. The official line is that lower demand will lead to lower prices. Realistically, less demand is the product of less supply, so it does not lead to lower prices. And here we must turn to the second panel in Figure 2, of the OBR’s modelling of real GDP.

With the annual increase in the RPI already at 11.8% and that of the CPI at 9.1%, a bank rate of 1.25% fails to recognise the changed environment. Interest rates, bond yields and therefore the cost of government funding are all set to rise substantially. The consequences for financial assets will be to drive their market values lower. And unprofitable businesses relying on finance for their existence risk being wiped out, either because they will lose hope of ever being economic, or bank credit will be withdrawn from them.

All empirical evidence is that currency debasement accompanies the destitution of an economy. Therefore, it is a mistake to think that a slump in business activity will neutralise the inflation problem. To deal with the inflation problem, the new prime minister will have to resist intervening and let all failing businesses go to the wall. But whoever becomes PM, there is no mandate to simply let events take their course. Instead, the burden of sustaining a failing economy will certainly lead to a soaring fiscal deficit — financed, of course, by yet more monetary debasement.

Without quantitative easing, the appetite of commercial banks for financing the fiscal deficit at a time of rising bond yields is uncertain. It is a different environment from a long-term trend of declining interest rates, underwriting bond prices. A trend of rising interest rates is likely to lead to funding dislocations, as we saw in the 1970s. Furthermore, commercial banks have more urgent problems to deal with, which is our next topic.

Banks will be in self-preservation mode

GDP is no more than a measure of currency and credit in qualifying transactions. Growth in nominal GDP is a direct consequence of an increase in currency and bank credit, particularly the latter. An old rule of thumb was credit was larger than currency in the ratio of perhaps ten to one. The evolution of banking, the war on cash, and the advent of debit cards have changed that, and since covid, the ratio has increased to 37:1.

This means that changes in nominal GDP are almost entirely dependent on the supply of bank credit for the production of goods and services. The availability of customer deposits to draw down for spending reflect the commercial banking network’s willingness to maintain the asset side of their balance sheets, comprised of lending and financial investment. Customer deposits, which are a bank’s liabilities, will contract if bank lending, recorded as a bank’s assets, contract. This is already evident in the slowing down of broad measures of money supply growth.

Given that bank balance sheets are highly leveraged, and that the economic outlook is deteriorating, bank lending is almost certainly beginning to contract. This vital point appears to be completely absent in the OBR’s modelling of the economic outlook.

By the usual metrics, commercial banks are extremely over-leveraged after thirteen years of the current bank credit cycle, in other words since the Lehman failure. Table 1 below summarises the position of the three British G-SIBs (designated global systemically important banks). They can be regarded as a banking proxy for exposure to global systemic risks.

Important points to note are that balance sheet leverage, the relationship of assets to total equity, are as much as double multiples of between eight and twelve times at the top of a normal bank credit cycle. Balance sheet equity includes accumulated undistributed profits as well as the common equity entitled to them.[i] All three banks’ common shares trade at substantial discounts to their book value.

Their share prices tell us that markets have assessed that there is a high level of systemic risk in these banks’ shares. It would be extraordinary if the directors of these banks are blind to this message. Before covid when economic dangers were less apparent, it would have been understandable though not necessarily excusable for them to use this leverage to maximise profits, particularly since all banks were following similar lending policies.

Covid came, and all banks had no option but to extend loan facilities to businesses affected, for fear of triggering substantial loan losses on a scale to take down the banks themselves. Furthermore, the government put in loan guarantee schemes. Post-covid, bankers face the withdrawal of government loan guarantees, rising interest rates and the consequences for their risk exposure to higher interest rates, as well as declining values for mark-to-market financial assets — the latter affecting both bank investments and collateral against loans.

Clearly, the cycle of bank credit is on the turn and will contract. The dynamics behind this phase of the cycle indicate that to take leverage back down to more conservative levels the contraction will have to be severe. But an excessive restriction of credit both causes and produces a run for cash notes and gold. And thus, without intervention banks and businesses all collapse in a universal crash.

With very little of GDP recorded in pound notes and coin, as a statistic it is driven overwhelmingly by the quantity of bank credit outstanding. In a credit contraction the GDP statistic will collapse — unless the Bank of England takes upon itself the replacement of credit in a massive economic support programme.

The consequences are sure to undermine government finances badly. Sunak’s hope that a balanced budget can be maintained, let alone permit him to oversee tax cuts when government finances permit, becomes a fairy tale when tax revenues slump and spending commitments increase. So, too, is Truss’s belief that immediate tax cuts will benefit economic growth and restore tax revenues. The reality of office is likely to decree fiscal policies very different being those being touted by both candidates.

The impending collapse of the euro system

I wrote recently for Goldmoney about the inevitable crisis developing in the euro system, here. Since that article was published, the European Central Bank has raised its deposit rate to zero and instituted a rescue package for the highly indebted PIGS in its awkwardly named Transmission Protection Instrument. In plain language, the ECB will continue to buy PIGS government debt to ensure their yields do not rise much further relative to benchmark German bunds.

It is increasingly clear that the euro system is in deep trouble, caught out by the surge in consumer price inflation. Rising interest rates, which have only just started, will undermine Eurozone commercial bank balance sheets because they obtain much of their liquidity by borrowing through the repo market.[ii] TARGET2 imbalances threaten to collapse the system from within as the interest rate environment changes. The ECB and its shareholding network of national central banks all face escalating losses on their bonds, which earlier this month I calculated to be in the region of €750bn, nearly seven times the combined euro system balance sheet equity.

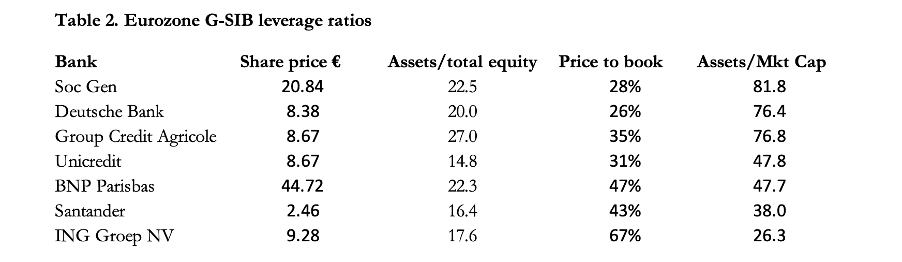

Not only does the whole euro system require to be refinanced, but this is at a time when the Eurozone’s G-SIBs are even more highly leveraged than the three British ones. Table 2 updates the one in my article referred to above.

With the average Eurozone G-SIB asset to equity ratios of over 20 times, the euro’s G-SIBs are one of the two most highly leveraged networks in global banking, the other being Japan’s. The common factor is negative interest rates imposed by their central banks. The consequence has been to squeeze credit margins to the extent that the only way in which banks can sustain profit levels is to increase operational gearing. Furthermore, an average balance sheet leverage of over 20 times does not properly identify systemic risks. Bank problems come from extremes, and we can see that at 27 times, Group Credit Agricole should concern us most in this list. And we don’t see all the other Eurozone banks trading internationally that don’t make the G-SIB list, some of which are likely to be similarly exposed.

The problem for Britain is twofold. Including its banks, Britain’s financial system is more exposed to Eurozone risks than any other, and a Euro system failure would be a catastrophe for it. Furthermore, Eurozone banks and fund managers use UK clearing houses for commercial euro settlements. Counterparty failures will contaminate systemically all participants, not only dealing in euros but all the other major currencies settled in London as well. The damage is sure to extend to forex and credit markets, including all OTC derivatives which are an integral part of bank clearing facilities.

At the last turn of the bank lending cycle, it was the securitisation of liar loans in the US which led to what is commonly referred to as the Great Financial Crisis. This is a term I have rarely used, preferring to call it the Lehman Crisis because I knew, along with many others, that the non-resolution of the excesses at the time would store up for an even greater crisis in the future. We can now begin see how it will be manifested. And this time, it looks like being centred on London as a financial centre rather than New York.

We must hope that a collapse of the euro system will not happen, but there is mounting evidence that it will indeed occur. The falling row of dominoes is pointing at London, and it could even happen before the Conservative Party membership have voted for either Truss or Sunak in early-September.

Dealing with a banking crisis fall out

On the advice of the Bank for International Settlements, following the Lehman crisis the G20 member states agreed to make bail-ins mandatory, replacing bailouts. This was a politically motivated move, fuelled by the emotive belief that bailing out banks are at the taxpayers’ expense. In fact, bank bailouts are financed by central banks, both directly and indirectly. The only taxpayer involvement is marginally through their aggregated savings in pension funds and insurance companies. But these funds have been over-compensated with extra cash through quantitative easing. The audit trail leads to the expansion of currency and credit every time, and not to taxes as the phrase “taxpayer liabilities” implies.

All the G20 nations have passed legislation enabling bail-in procedures. In the Bank of England’s case, it retains discretion to what extent bail-in as opposed to other rescue methods might be used. As to specifics for the other G20 members it is unclear to what extent they have retained this flexibility and understand bail-in ramifications. And it could be an additional confusion likely to complicate a global banking rescue, compared with the previously accepted bail-out procedures.

In theory, a bail-in reallocates a bank’s liabilities from deposits and loans into shareholders’ capital — excepting, perhaps, smaller depositors covered by deposit guarantee schemes. But even that is at the authorities’ discretion.

The objective can only make sense for single bank, as opposed to systemic failures. But if it were to be applied to an individual banking failure in the current unstable situation, it would almost certainly undermine other banks, as bank loans and other non-equity interests would be generally liquidated, and deposits flee to banks deemed to be safer as panic sets in. The risk is that bail-in procedures could set off a system-wide failure, particularly of the banks rated by the market with substantial discounts to book value — including all the UK’s G-SIBs (see Table 1 above).

Even assuming the Bank’s bail-in procedures are ruled out in dealing with a systemic banking crisis, to keep banks operating will require a massive expansion of credit from the Bank of England. In effect, the central bank will end up taking on the entire banking system’s obligations. With London at the centre of a global banking crisis, all other major central banks whose banking and currency networks are exposed to it must be prepared to take on all their commercial banking obligations as well.

Britain’s place in the world must be secured

The problems attendant on currencies afflict all the majors, with the UK at the centre of the storm because of its pre-eminent role in international markets. There is no evidence that the leadership at the Bank of England is equipped to understand and deal with an increasingly inevitable economic and monetary crisis which will take sterling down. Nor has there been any attempt by the Treasury to rebuild the nation’s depleted gold reserves to protect the currency, which is a gross dereliction of public duty.

But we must now turn our attention to geopolitical matters, where there is currently no pragmatism in Britain’s foreign policies. Since President Trump’s aggressive stance against the challenge to America from Chinese technology, the UK as America’s most important partner in the five-eyes intelligence sharing agreement has sided very firmly with America against both Chinese and Russian interests.

The recent history of the five-eyes partnership is one of political blindness — ironic given its title. Wars against terrorism, more correctly US intelligence operations which destabilise Muslim nations before the military go in to sort the mess out have been a staple since the overthrow of Saddam Hussein. A series of wars in the Middle East and Afghanistan have yielded America and her NATO allies only pyrrhic victories at best, created business for the US armaments industry, and resulted in floods of refugees attempting to enter Europe.

Meanwhile, these actions have only served to cement the partnership between Russia, China, and all the Asian members of the Shanghai Cooperation Organisation amounting to over 40% of the world population. They have a common mission to escape from the dollar’s hegemony.

America’s abandonment of Afghanistan was pivotal. As America’s closest intelligence partner, Britain following Brexit is no longer a direct influence in Europe’s domestic politics. Together, these factors have surely encouraged Putin to adopt more aggressive tactics with the objective of undermining the NATO partnership, always seen as the principal threat to Russia’s borders.

This is the true objective behind his proxy war against Ukraine. Supported by Britain, the US response has been to fuel the Ukrainian proxy war by supplying military hardware. But the biggest mistake made by the NATO partnership has been to impose sanctions on Russian trade.

The consequences for energy and other vital commodity prices do not bear unnecessary repetition. The knock-on effects for global food prices and the shortages emerging ahead of the winter months are still evolving. Sanctions have become NATO’s suicide note — it is beginning to look like a modern version of Custer’s last stand.

It is surely to the private horror of Western strategists that the sense behind Putin’s strategy is emerging: it is to further the economic consolidation of Asia with the unfettered advantages of fossil fuels traded at significant discounts to world prices. At their own behest, America and its NATO allies are shut out of it entirely.

Global fears of climate change and the war against fossil fuels are essentially a Western concept, not shared by the great Asian powers and the Middle East. The hysteria over fossil fuel consumption has led European nations to eliminate their own production in favour of renewables. Consequently, to make up energy shortfalls they have become dependent on imported oil and gas from Russia. And that is what will split Europe away from US hegemony.

Unrestricted energy supply is crucial for positive economic outcomes. The result of US-led sanctions is that energy starvation faces all her allies, including Britain and the members of the European Union. As an oil-producing nation herself, America is less affected, her allies suffering the brunt of sanctions against Russian energy supplies.

By committing to policies to lessen climate change without fossil fuel sources of energy, the economic prospects for Europe and the UK are of economic decline.

Only last weekend agreements have been signed between Russia, Iran, and Turkey, with Iran due to become a full member of the Shanghai Cooperation Organisation later this year. Other than Turkey’s wider economic interest, it is essentially about oil. In addition to these developments, Russia’s Foreign Secretary Sergei Lavrov went on to address the Arab League in Cairo. It is clear that Russia is building its relationship with oil producers in the Middle East as well, whose members are faced with declining Western markets and growing Asian demand.

Therefore, British policy tied into US hegemony with a self-imposed starvation of energy is untenable. It is worse than being on the losing side. It guarantees economic decline relative to the emerging Asian powers. A future Prime Minister needs to pursue a more pragmatic course than the bellicose stance against Russia and China, currently espoused by Liz Truss. As Britain’s current Foreign Secretary, she is briefed by the UK’s intelligence services, which are closely aligned with their American colleagues. There is groupthink going on, which must be overcome.

The interest rate trend and the looming threat of the mother of all financial crises on London’s doorstep requires a leadership strong enough to take on the civil service, always complacent, and guide the wider electorate through some troubling times. Following the financial and currency crisis, mindsets must be radically changed, steered away from perpetual socialisation of economic resources back towards free markets. Which of these two candidates for the premiership see us through? Probably neither, though being less a child of the establishment Liz Truss might offer a slim chance.

The task is not impossible. Currencies have completely collapsed before, and nations survived. Instead of being restricted to one or a group of nations, the looming crisis threatens to take out what we used to call the advanced economies in their entirety, so it will be a bigger deal. Fortunately for Britain, her citizens are less likely to riot than their continental cousins. But as a warm-up for the main event, our new leader will have to navigate through growing discontent brought on by rising prices, labour strikes and all the other forms of economic pestilence which bought Margaret Thatcher to power.

[i] Only Standard Chartered has additional preference shares, but they are not a significant quantity relative to its common equity.

[ii] A healthy bank obtains its liquidity by creating loans and balancing deposit liabilities. Everything has conspired against eurozone banks pursuing this means of managing their balance sheets: regulations deeming commercial lending to be high risk, a stagnating eurozone economy, and negative interest rates compressing lending margins. Consequently, while their balance sheets have been expanded to maintain profits, their reliance on repo liquidity has replaced customer deposits.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.