Goldmoney Inc. Shareholder Letter for 2022

Jun 22, 2022Download the Shareholder Letter Here

Dear Fellow Shareholders,

The table below provides a measurement of the growth in our tangible equity per share over the past five years[1].

As can be seen, Goldmoney has been growing its net worth on a tangible basis. In fiscal 2022, our tangible equity grew by roughly $9 million. By including the per share metrics we can further see how, as the company repurchases and cancels shares, tangible equity per share increases for long-term shareholders. As of March 31, 2018, our tangible equity per share was $1.38. On March 31, 2022, that same metric was $1.78 per share. It is worth noting that in this calculation, the MENE investment is not being valued based on MENE’s market price but based on an accounting formula. For example, as of March 31, 2022, MENE was valued at $35 million on our balance sheet while the value of our shares in the market was closer to $60 million.

Over the past five years Goldmoney Inc. has generated significant returns on its tangible capital and has compounded its net worth even while spending nearly $20 million of tangible capital on exploratory, legal, and other non-recurring activities. In 2018, a shareholder of Goldmoney would have paid $3.30 per share for a company with $1.38 in tangible equity per share. On March 31, 2022 a shareholder would have paid $1.95 per share for a company with $1.78 in tangible equity per share. In other words, the gap between our intrinsic value or sum-of-parts value and our market value has essentially diminished over the past five years. To me, this is a clear indication that our company is maturing from one that is valued by investors according to growth projections into a company valued according to its net asset value.

Some may say that this transition is unfortunate for the market no longer believes in our company’s growth potential. I would counter that while investors may now appear to be less focused on our long-term prospects, we have demonstrated great discipline over the past five years by solidifying and growing our financial position. As a company we have never been more profitable or more financially formidable as we are today. I would also draw attention to the long list of companies who pursued nominal growth in revenue rather than tangible growth in equity that have seen their valuations repriced rather quickly to levels which would have seemed impossible just a year ago. At Goldmoney, we resisted the temptation to grow at all costs during a period of artificially low interest rates. In contradistinction, companies that pursued the “growth at all costs” strategy have balance sheets that are far weaker and debt levels that are far greater today than in 2018.

Personally, I prefer being in our position where, on the one hand, the market has momentarily given up on our growth potential, while, on the other hand, new long-term oriented shareholders may invest in our company at levels that provide significant downside protection with an option on our upside potential.

Precious Metal Position

Our precious metals position continues to grow in line with the targets we have set in previous shareholder letters. At the time of writing (June 16, 2022), Goldmoney Inc. holds $65.9 million of precious metals on its balance sheet compared to $56.4 million on June 11, 2021. Here is the breakdown of our current precious metals position at the time of writing:

573,276 Grams of Gold…………………..…$43.2 million[2]

624,128 Ounces of Silver…………………..$17.1 million[3]

111,143 Grams of Platinum………………...$4.4 million[4]

14,823 Grams of Palladium…………….…$1.2 million

When compared to our precious metal position last year, we can see how the weights of gold and silver have increased significantly. We expect that our precious metal position will continue to grow over the coming years as our core operational businesses retain their profits in metal for the forseeable future. We hope that by this time next year we will be able to say that Goldmoney Inc. has $1 a share of precious metals value.

Share Repurchases

In fiscal 2022, Goldmoney Inc. repurchased and canceled 474,500 shares for a total of $1,008,812. These shares were purchased between Nov and March of 2022. Since the start of fiscal 2023, we have repurchased and canceled a further 757,300 shares for a total of $1,275,295. At the time of writing, Goldmoney Inc.’s outstanding share count is 74,943,908. Returning to the table in page 1, we can see how our tangible equity per share (as of March 31, 2022) computed against this lower outstanding share count increases from $1.78 to $1.80 per share. We hope to continue repurchasing shares at prevailing market prices as we believe this strategy to be greatly beneficial to our long-term shareholders.

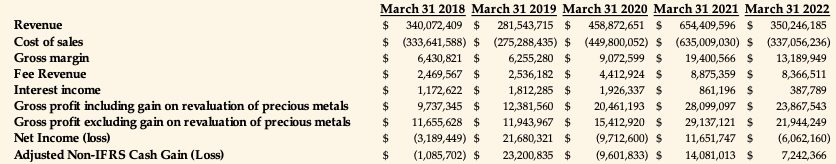

Goldmoney Inc. Operational Update I would like to remind shareholders that Goldmoney Inc.’s fiscal year end is March rather than December. Therefore, Fiscal Year 2022 figures reflect the 12 month period from April 1, 2021 through March 31, 2022. We consider our decline in revenue over this period to reflect normal volatility within the precious metals industry. The Fiscal 2021 period included some very active trading months during the Covid-19 macroeconomic backdrop while the majority of the Fiscal 2022 was quite tepid. Indeed nearly 35% of our Fiscal 2022 revenue was generated in Q4 2022 during the outbreak of the Ukraine war. We do not pay too much attention to the year over year volatility in our topline revenue because our primary focus is to produce profits and by consequence growth in our tangible capital per share. We are pleased to have achieved that goal in fiscal 2022 with the final quarter of the year producing record quarterly profits and cash flow. In the final quarter of 2022, Goldmoney Inc produced $4,883,068 of Adjusted IFRS Net Income. Goldmoney.com ended the year with $2.23 billion of client assets.

I would like to remind shareholders that Goldmoney Inc.’s fiscal year end is March rather than December. Therefore, Fiscal Year 2022 figures reflect the 12 month period from April 1, 2021 through March 31, 2022. We consider our decline in revenue over this period to reflect normal volatility within the precious metals industry. The Fiscal 2021 period included some very active trading months during the Covid-19 macroeconomic backdrop while the majority of the Fiscal 2022 was quite tepid. Indeed nearly 35% of our Fiscal 2022 revenue was generated in Q4 2022 during the outbreak of the Ukraine war. We do not pay too much attention to the year over year volatility in our topline revenue because our primary focus is to produce profits and by consequence growth in our tangible capital per share. We are pleased to have achieved that goal in fiscal 2022 with the final quarter of the year producing record quarterly profits and cash flow. In the final quarter of 2022, Goldmoney Inc produced $4,883,068 of Adjusted IFRS Net Income. Goldmoney.com ended the year with $2.23 billion of client assets.

The board of directors chose to write down a large part of our Goodwill which is an accounting entry that arises when an acquisition is made. In our case, when acquiring Goldmoney.com in 2015, we allocated $32,722,163 into Goodwill reflecting the premium we paid over the tangible capital acquired. One of the reasons we have always used the metric “tangible equity” or “tangible equity per share” is because we exclude all non-tangible items from our balance sheet when assessing the company’s intrinsic value and performance. Therefore, the reduction in Goodwill is a non-cash event that simplifies the balance sheet by reducing intangibles. Unfortunately, a write down of intangibles does accrue to the overall profit line item according to IFRS accounting rules. Consequently, investors should look past this non-cash item and focus on the growth in tangible equity per share or the adjusted non-IFRS profit which Goldmoney Inc. produced in 2022.

Menē

In 2021, Mene become a profitable business generating $26,773,259 in Revenue and $304,288 in Operating Income. Mene is now valued by the market at $160 million which is higher than the current market value of Goldmoney Inc. I believe this fact validates our group’s entrepreneurial abilities and demonstrates our ability to innovate, build, and execute. Goldmoney Inc. currently owns 93,692,949 shares of Menē, with a mark to market value of $55 million.

Summary of our Fiscal 2022 Year Activities

In conclusion, fiscal 2022 was a very good year for Goldmoney Inc. We have simplified our group’s operating structure, increased our net worth, reduced our operating expenses, increased our precious metal position, and continued to ramp up our share repurchase program. We have transformed Goldmoney Inc. into a company with a strong balance sheet that compounds by earning returns from our existing operational businesses. We have also set the stage for continued growth in our balance sheet via capital appreciation and new investments within the real economy.

I would like to thank Goldmoney Inc. shareholders and clients for their continued trust and support. I would also like to thank our executive team and colleagues for their outstanding performance this year, especially Paul Mennega, Alessandro Premoli, Mark Olson, Rachel Stonier, Serge Prostran, Will Felsky, and Renee Wei. I would also like to thank our board of directors led by James Turk, Mahendra Naik, Andres Finkielzstain, and Stefan Wieler for their continued service in guiding our company with wisdom and prudence.

* * *

The current state of technology and how it should be employed in business

I have always thought of technology as a tool no different than a hammer. A tool is an extension of our body that helps us to achieve a particular function. The problem I have come to see with the state of technology in our world today is that it has become a tool without a definite purpose or function. When I log on to social media, I do not have a particular purpose in mind. Within a few seconds, I am inundated with so much content that I have forgotten why I logged on in the first place.

I view social media as an anti-technology. No longer serving as a helpmeet to fulfill various actions within the present, social media merely distracts us from our stated purpose. My own purpose as an executive at Goldmoney is to eliminate noise so that I may focus on our mission and gain proper insights into the current state of the world which may affect our business.

I find it hard to believe that the current fashion of CEOs’ obsession with social media will be sustainable. I suspect that, in a few years, we shall look back at this whole trend as an undesirable accretion of modern technology, not dissimilar to reality television. There are so many things to focus on during the day for an executive of a publicly listed company. The notion that one can actively engage with social media while fastidiously operating a multi-layered business fails the test of reason. I happen to know several of the leading technology CEOs and my own observation is that they spend far more time immersed in distractions than they let on. To me, this phenomena is just another symptom of artificial interest rates and the general bubble in stock market valuations since the demonetization of precious metals in 1971. Perhaps what made this latest bubble so acute was the ability for CEOs to constantly distract themselves as well as their shareholders from financial metrics and tangible progress through the use of social media. Indeed, a recent economic paper[5] shows that in 2019, 54.4% of US publicly listed firms were profitless, up from 18.3% in 1970. The data for IPOs is even more illuminating with 77% of newly listed firms being profitless up from 24% in 1980.

I also think that, with any tool, there is the risk that we become accessories of the tool itself rather than the tool being a useful extension for the purpose of our activities. There is a question of values here. The more we use something without a definite purpose, the more we become moulded by it. The Canadian philosopher Marshall McLuhan put it in this way: “The basic thing to remember about electric media is that they inexorably transform every sense ratio and thus recondition and restructure all our values and institutions.”

I was originally drawn to sound money principles because I felt there to be a great injustice pervading our economic and monetary orders. Over the years, I have come to appreciate just how much technology, media, and social media has played a role in enabling and maintaining that injustice. The current state of technology empowers a structure of power which includes politicians, oligarchs, and academics. From running deficits, to financing war, to debasing currency, actions taken by these individuals affect the lives of billions of people every day. And yet, it appears that at least in recent times, the structure of power operates with no accountability to the people or the natural order.

Here is an example which I believe helps to elucidate my argument. We have now seen no shortage of evidence that central banks are solely responsible for both the latest bubble in asset valuations as well as the horrendous inflation which has pined the hearts and savings of the common man. At this juncture, the most reasonable course of action would be to hold meaningful public conversations about abolishing central banking or fiat money. We should be seeing billions of people expressing this view right now both in the real and virtual worlds. Instead, the techno-media oligopoly distracts us with content that focuses our attention on analyzing the next action or commentary from the central bank. While inflation and recession abound, putting into question the integrity of these institutions or their necessity, the world desperately awaits for their next decision. Will they raise rates? Will they lower them? What industries will the next fiscal stimulus subsidize? We all suffer from a collective case of Stockholm Syndrome and we cannot even lift our heads above it all to plan an escape from our kidnappers.

A just economic system backed by sound money and oriented towards the real economy would inhibit the structure of power from poorly guided policies and most importantly, hold them accountable for their failures. We must, as sound money proponents, begin to recognize this and reorient our actions towards the real economy. If more people resisted technology and social media, if more people engaged with the real economy, we might actually stand a chance at building the kind of foundation required to catalyze a shift in attitude that would reform the current monetary system.

In one of my last interviews with Marty Bent in April 2020, I mentioned how I was observing that the younger generation would come to reject technology or not embrace it as fervorously as my own generation had. I have seen further evidence in this regard with a recent article interviewing college students who called social media “the ultimate waste.”[6]

In other words, I also think that social media, and indeed many of the internet-based technologies that have come to dominate our worldview since the turn of the century, are becoming less “cool.” If that statement makes you shiver in disbelief, just keep in mind that we are contrarians here at Goldmoney and that being pro-technology is currently the most mainstream view one can hold.

So what do we do today as a business which employs technology to deliver a service? On the one hand, we must embrace technology, for this is how our businesses reach and empower our clients. On the other hand, our actual business centers on the trading and storage of physical metals in real vaults around the world. In our case, technology is merely being used as a tool to reach people who may not live near our place of business.

In order to strike the right balance, I have made the decision to relaunch the Goldmoney.com website with a new experiment that demonstrates how I think technology in general and the internet more specifically can be refashioned as a tool with a definite purpose. The new website does away with distractions. It has a minimal colour scheme and is primarily textual. The website allows new clients to join Goldmoney and existing clients to use Goldmoney with ease and simplicity from any internet enabled device. Our research portal has been redesigned with the same principle. Finally, we do not link or interface with any social media plugins. This may all seem quite banal but I think it is rather important. This is a first step in trying to reclaim control over technology. It is a decision that extends our brand to like-minded people who simply see in our service a tool to protect their wealth.

Macroeconomics and Geopolitical War

In last year’s letter, I stated that “The geopolitical situation is far more precarious than our global leaders would have us believe”. I am most displeased to see that my prediction has so quickly materialized. The geopolitical situation today is, in my view, the most fragile since the end of the Second World War. Investors need to be extremely careful about counterparty risk and recognize that only gold is money, especially during times of war. We are likely just a few missteps away from more armed conflict that will increase deficit spending at a time when inflation is gnawing away at savings and capital. I suspect that the first domino to fall will be the euro.

The greater risk to those of us who actually cherish our Western culture and traditions is that on February 24, 2022 the global order fractured into two. There is the Western order which remains stronger and more capable for the moment. However, there is now a Non-Western contingent of countries who are primarily oriented towards the real economy that will grow in power to the point of becoming the new hegemonic order in just a few years. Any military conflict between these two orders will potentially delay this shift but only a fundamental reorientation of the Western economies towards the real will provide the necessary capital to withstand the coming challenges. It is too early to tell which of these paths will be pursued by our Western leaders. I am most concerned about the decision to pursue military conflict whilst not making the necessary changes to our economic and monetary systems.

On the purely economic side, and assuming no escalation in geopolitical tension, specific conversations I have had with central bankers in Europe lead me to the conclusion that they are not prepared to deal with the impending series of macroeconomic events. Farmers are unable to produce a profit even with heightened commodity prices due to the surge in input costs. Fertilizer, feed, energy, labour, and now interest rates have all increased significantly. Most farmers I know are beginning to consider alternative models that exclude input costs as much as possible. As an example, farmers prefer to grow less crop or have less livestock grazing per acre if that means that they can eliminate fertilizer and feed costs. The result to the farmer is roughly the same revenue given the rise in commodity prices. The result for society however is less food supply. Nature provides us with fixed crop yields that have never changed. The only thing that changed was our decision to apply technology (energy) and fertilizer to produce more food from the same plot of land. But this trend now appears to be changing and it will have wide-ranging implications. The ghost of Malthus haunts us yet again.

The decline in fertility rates may help soften the blow, but only if central banks raise interest rates and reign in inflation. At the current moment, I believe central bankers do not have the political will to do that. The ones I have been speaking to keep using the term “growth recession” to describe their course of action; as in they are just trying to slow things down a bit so that we may return to nominal growth. The natural order will not allow this outcome. If central banks reverse course before inflation has been controlled, the result will be a rapid shift in power from the West to the Non-Western nations. The greatest hope the West has is to deal with this matter now and swallow the bitter pill of a prolonged economic recession. And once the chaff has been burned off from this unsustainable economic system, to re-adopt sound money. As a contrarian, this does not seem to me entirely unfathomable. Western nations retain large amounts of precious metal on their balance sheet. The Non-Western order has already begun to implement a commodity based monetary standard. We are only a few months away from a period in which global capital flows will need to be de jure linked to commodities. They are already linked de facto.

Let us hope that our leaders have the wisdom and foresight to see us through this difficult period. I pray that they make the right decisions over the course of 2023. Being a proponent of sound money does not mean that we are anti-government or even libertarian, though many sound money proponents are. To me, it just means that we are citizens who wish to conserve our society, our culture, and our natural environment for our children. The surest way of achieving sustainable prosperity is to link our societies and thus our economies to the natural order. In other words, that our money be gold.

Sincerely,

Roy Sebag

Founder and Chief Executive Officer

Goldmoney Inc.

Forward‐Looking Statements

This shareholder letter contains or refers to certain forward‐looking information often be identified by forwardlooking words such as “anticipate”, “believe”, “expect”, “plan”, “intend”, “estimate”, “may”, “potential” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. All information other than information regarding historical fact, which addresses activities, events or developments that the Goldmoney Inc. (the “Company”) believes, expects or anticipates will or may occur in the future, is forward looking information. Forward‐looking information does not constitute historical fact but reflects the current expectations the Company regarding future results or events based on information that is currently available. By their nature, forward‐looking statements involve numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and other forward‐looking information will not occur. Such forward‐looking information in this shareholder letter speak only as of the date hereof. Please refer to those risks set out in the public documents of the Company filed on https://www.sedar.com. The Company undertakes no obligation to update or revise any forward‐looking information, except as required by law. No stock exchange, regulation services provider, securities commission or other regulatory authority has approved or disapproved the information contained in this shareholder letter or accepts responsibility for the adequacy or accuracy of the content of this newsletter.

Non-IFRS Measures

This shareholder letter contains non-IFRS financial measures; the Company believes that these measures provide investors with useful supplemental information about the financial performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business. Although management believes these financial measures are important in evaluating the Company's performance, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed as alternatives to measures of financial performance determined in accordance with IFRS. Moreover, presentation of certain of these measures is provided for year-over-year comparison purposes, and investors should be cautioned that the effect of the adjustments thereto provided herein have an actual effect on the Company's operating results.

Tangible Capital is a non-IFRS measure. This figure excludes from total shareholder equity (i) intangibles, and (ii) goodwill, and is useful to demonstrate the tangible capital employed by the business.

Gross profit excluding gain/loss on revaluation of inventories is a non-IFRS measure, calculated as gross profit less gain/(loss) on revaluation of precious metals. The closest comparable IFRS financial measure is gross profit. Fluctuations in the value of its precious metal inventories caused by fluctuations in market prices are included in gross profit. Management believes that excluding such fluctuations more clearly illustrates the Company’s business operations.

Non-IFRS Adjusted Gain (Loss) is a non-IFRS measure, defined as total comprehensive income (loss) adjusted for non-cash and non-core items which include, but is not limited to, revaluation of precious metal inventories, stock-based compensation, depreciation and amortization, foreign exchange fluctuations and gains and losses on investments.

For a full reconciliation of non-IFRS financial measures used herein to their nearest IFRS equivalents, please see the section entitled "Reconciliation of Non-IFRS Financial Measures" in the Company's MD&A for the year ended March 31, 2022.

[1] Please refer to “Non-IFRS Financial Measures” at the end of this shareholder letter.

[2] This figure includes 4,229 grams of gold coins held through SchiffGold as well as 135,098 grams held in the form of 24k gold jewelry backing the precious metal loan to Mene from Goldmoney Inc.

[3] This figure includes 21,400 ounces of silver coins held through SchiffGold, LLC.

[4] This figure includes 100,227 grams held in the form of platinum bullion as well as 10,916 grams held in the form of 24k platinum jewelry backing the precious metal loan to Mene from Goldmoney Inc.

[5] Su, Daniel. (2022) “The Rise of (Mega-) Firms with Negative Net Earnings” SSRN Electronic Journal https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4065772

[6] https://nypost.com/2022/04/18/the-ultimate-waste-gen-z-says-no-to-tiktok-social-media/