Goldmoney vs. ETF

The benefits of a Goldmoney holding include the assurance of knowing that gold, silver, platinum, and palladium group metals are held in secure and insured vaults, fully identified as owned by individual Goldmoney clients. This form of direct individual ownership is superior to owning a share (or shares) of a corporate entity or trust, such as listed ETFs or other collective vehicles, for several reasons. First, a holding in a metal ETF is a form of indirect rather than direct legal ownership, as it is the intermediary, rather than individual, that owns the metal.

Second, physical ETFs are designed so that their shares closely track the price of physical gold. For this service, they charge annual management fees of approximately 0.4-0.6% per annum. This is three to four times greater than the annual all-in fee paid by Goldmoney clients for the secure storage, bar testing, insurance, and audits of their gold as well as the full suite of additional features and services provided by Goldmoney.

Third, some ETF prospectuses point to possible risks, such as that redemptions may be suspended temporarily or indefinitely at the discretion of the management company, and that custodians may be free to appoint sub-custodians, whose performance cannot be guaranteed.

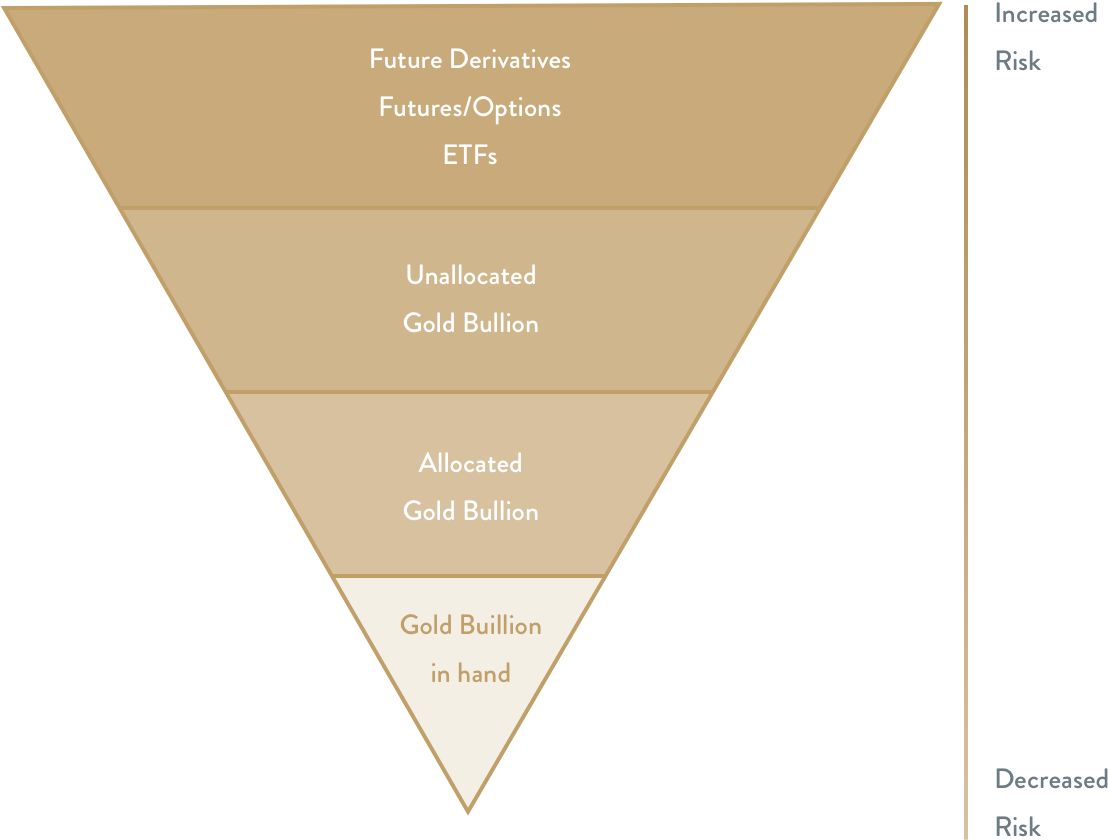

Finally, some ETFs do not own all physical metal directly, but gain their exposure to gold and silver prices in whole or part through futures, options, swaps, leases or other derivatives, which have some combination of exchange, issuer and counterparty risk. These risks can be difficult to quantify, in particular in the event of a financial crisis.