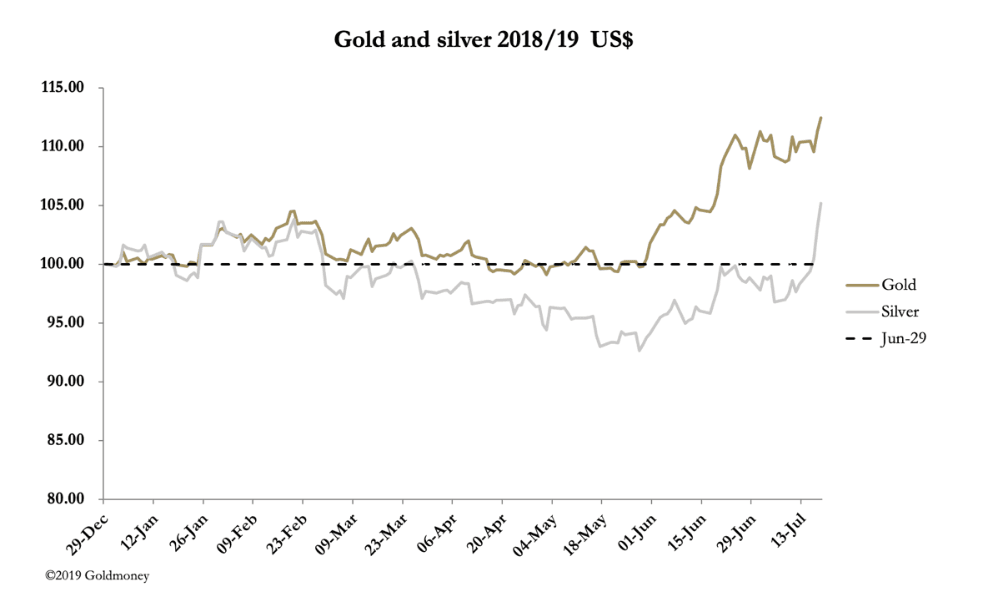

Market Report: Silver stars in bull run

Jul 19, 2019·Alasdair Macleod

Gold’s move is certainly catching the attention of investing institutions around the world, which could afford to be complacent so long as the gold priced was capped below $1360. Those days are gone, leaving them underexposed to an asset that’s telling them a new story. The move towards lower dollar interest rates has gained momentum, with John Williams, President of the New York Fed saying yesterday that the Fed should take swift action, including returning interest rates to the zero bound.

It was interpreted as policy, which is jumping the gun, but it woke up markets to the severity of the recession threat and the possibility of a two-notch cut in the Fed funds rate as soon as this month.

How do those not yet invested in gold play it? They will be looking at the gold chart with a view to timing entry. The technical position is shown below.

Clearly, gold is in a bull market, and after this sudden jump must be very overbought. That said, the potential overhang of investors trying to get their heads round what is happening must be enormous.

There are other factors. Central banks will be considering reserve asset allocation, as illustrated by a YouGov poll conducted for the World Gold Council released yesterday. The poll showed that emerging market and developing economy central banks intend to increase their gold reserves this year, at a similar pace to last year when central banks added 651 tonnes. The natural conclusion is that central bank demand will produce a comparable outturn this year.

The poll was completed on 17 June, when gold stood at $1340. This raises the question as to how gold’s subsequent price action will have affected intentions. A clue may be found in the poll’s other findings, particularly with respect to the renminbi. Here, over three quarters of central banks expect allocation to the Chinese currency to increase over the next five years, with one third expecting the shift to be substantial. While respondents seemed broadly ambivalent about dollar and euro allocations, the overall message indicates the geopolitical tectonic plates are shifting away from King Dollar.

No surprise here, perhaps. But as dollar interest rates move towards the zero bound and President Trump continues his new push for a lower dollar, maybe central banks will want to add to their gold reserves at a greater pace than the survey indicates. This could clash with the general public’s growing demand for physically-backed ETF holdings.

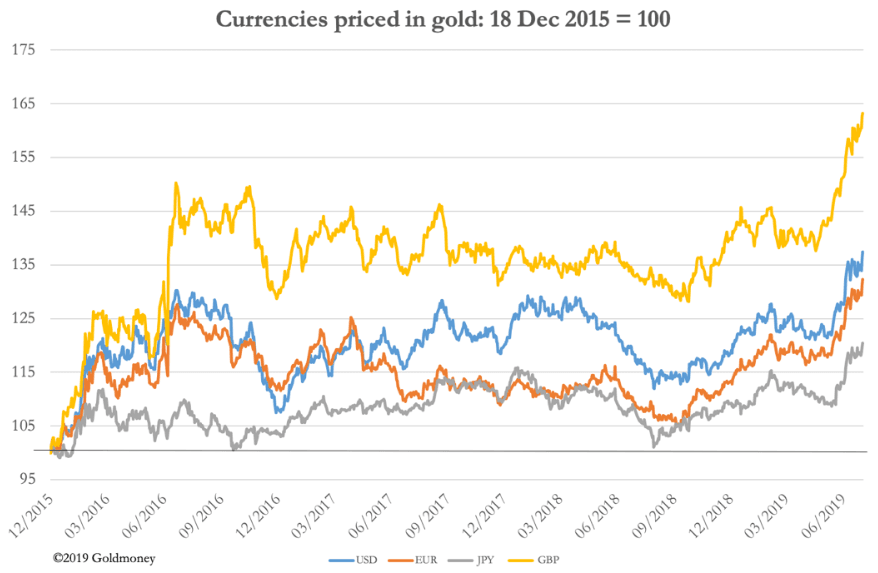

Our last chart records gold’s bull market in the four major currencies.

In sterling it has risen 63.2%, the US dollar 37.4%, the euro 32.4% and the Japanese yen 20.4%. Of course, the better way to look at it is fiat currencies are in decline.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.