A perfect storm in banking is brewing

Jun 16, 2022·Alasdair MacleodNow that interest rates are rising with much further to go, the global banking system faces a crisis on a scale like no other in history. Central banks loaded with financial securities acquired through QE face growing losses, and their balance sheet liabilities are now significantly greater than their assets — a condition which in the private sector is termed bankruptcy. They will need to be recapitalised urgently to retain credibility.

Furthermore, banking regulators have made a prodigious error in their oversight of the commercial banking system by focusing almost solely on bank balance sheet liquidity as the principal determinant of risk exposure. And on the few occasions in the past when they have demanded banks increase their own capital, it has always been through the creation of preference shares and pseudo-equities to avoid diluting the true shareholders. The consequence is that the level of leverage for common equity shareholders in the global systemically important banks has risen to stratospheric levels.

The regulators may be comfortable with their liquidity approach, but they have ignored the periodic certainty of a contraction in bank credit and the consequences for banks’ equity interests. Meanwhile, G-SIBs have asset to common equity ratios often more than fifty times, with some in the eurozone over seventy. It is hardly surprising that most G-SIBs are valued in the equity markets at substantial discounts to book value.

G-SIBs have accumulated excessive exposure to financial assets, both on-balance sheet and as loan collateral. With vicious bear markets now evident and further interest rate rises guaranteed by falling purchasing powers for currencies, the one thing regulators have not allowed for is now happening: like a deepening meteorological low, bank credit is contracting into a perfect storm.

Jamie Dimon’s recent warning that his bank (JPMorgan Chase) faces hurricane conditions confirms the timing. Central banks, bankrupt in all but name, will be tasked with rescuing entire commercial banking networks, bankrupted by a collapse in bank credit.

Why are markets crashing?

It is becoming clear that financial assets are in a bear market, driven by persistent rises in producer inputs and consumer prices, which in turn are pushing interest rates and bond yields higher. So far, investors have been reluctant to lose trust in their central banks which have been instrumental in supporting financial markets. But this is now being tested, more so in the summer months as global food shortages develop.

We have increasing evidence that bank credit is either contracting or on the verge of doing so. This was the message loud and clear from Jamie Dimon’s recent description of economic conditions being raised from storm to hurricane force, and his follow up comments about what JPMorgan Chase was doing about it. Rarely do we get the dollar-world’s most senior banker giving us such a clear heads-up on a change in lending policies, which we know will be shared by all his competitors. And the fact that the bank’s senior economist was tasked with rowing back on Dimon’s statement indicates that the Fed, or perhaps Dimon’s colleagues, know that he should not have made public their greatest fears.

Contracting bank credit always ends in a crisis of some sort. With a long-term average of ten years, this cycle of bank credit has been exceptionally long in the tooth. Before we even consider the specific factors behind a withdrawal of credit, we can assume that the longer the period of credit expansion that precedes it, the greater the slump in economic activity that follows.

Not only is this the culmination of a cyclical bank credit expansion, but it is of a larger trend set in motion in the mid-eighties. Following the inflationary seventies, which was book-ended with the abandonment of the Bretton Woods Agreement and Paul Volcker’s 20% prime rates, a means had to be devised to ensure that fiat currencies would be stabilised in a lower interest rate environment. By ensuring demand for dollars would always be sufficient to maintain its purchasing power, then all other currencies that were loosely pegged to it would be similarly able to retain purchasing power without the prop of high interest rates.

Consciously or unconsciously, the planners deployed a variation on the Triffin dilemma. Robert Triffin was an economist who in the 1960s pointed out that a reserve currency would have to ensure that there is sufficient supply of it for it to fulfil the reserve currency role. He concluded that the supplier of the reserve currency would have to run irresponsible short-term monetary policies to ensure the supply is made available, for the likely detriment of long-term monetary and economic prospects.

In the mid-eighties the planners put in place the mechanism for creating Triffin’s demand for the dollar. Deficits would be run by the US government, as Triffin had explained, and dollar bank credit would be expanded. The creation of bank credit outside the US banking system would be permitted in the form of the Eurodollar market. And the growth of shadow banking went unhampered.

Major banks were encouraged to buy into brokers, eventually absorbing them into their operations completely. London’s big-bang was what this was all about, followed by the Glass-Steagall Act being rescinded to allow the American money-centre banks to enter brokerage and investment banking activities in their domestic markets as well as offshore. The purpose of financialising the dollar was to ensure there would always be speculative and portfolio demand for it.

The policy has fundamentally overturned the way free markets behave, making them increasingly driven by central bank interest rate policies instead of by non-financial factors. Time preference became progressively less important relative to Fed policy. Whenever the dollar slipped, by lowering interest rates instead of raising them the Fed could encourage foreign portfolio buying. Lower interest rates increased flows of currency and credit into financial assets instead of debasing the currency in the non-financial economy.

It has not been a perfect system, because prices of goods and services still increased reflecting the expansion of currency and credit, but at a slower pace than one might have expected, given the increased quantity of circulating media. Furthermore, calculation methods applied to consumer price indices all had the effect of reducing the apparent pace of price increases. And it was in everyone’s interest to buy into this perpetual system of wealth creation.

Thus, the creation of extra bank credit was directed increasingly into financial speculation in bond and equity markets. There were bubbles, such as the dotcoms in the late-1990s and in mortgage financing preceding the financial crisis of 2008/09. Despite these interruptions, the US authorities made sure that global investment flows primarily supported US financial interests. Thus, the wealth effect was created in America, and consequently through the internationalisation of valuations in the jurisdictions of its major allies. And to the extent that credit expansion drove up financial asset prices, the effect was mostly ring-fenced within the financial economy, and was not recorded in official consumer price indices.

As markets caught on, interest rates declined to the point where they disappeared altogether. But as Triffin observed, policies to ensure that a currency is available as the world’s reserve are economically destructive in the long run, and the whole trend set in motion from London’s big bang onwards has now concluded with rising interest rates. It amounts to a super cycle of bank credit expansion certain to end more dramatically than a single cycle. Therefore, this bear market and its systemic issues can be expected to be of a greater magnitude than those which followed the dotcoms and the Lehman failure.

With interest rates so far beneath the rate at which prices are rising, which is mainly the consequence of earlier monetary debasement, losses are now accumulating for all those who bought into the financialisation story and have failed to bail out of it. Top of a hubristic list are the central banks themselves which augmented monetary expansion with the acquisition of substantial bond portfolios through quantitative easing. Those assets are now collapsing in value, wiping out central bank equity many times over. The central banks themselves will need recapitalising before they can tackle the problems of a widespread systemic collapse in the commercial banking network.

How to recapitalise a central bank

A central bank, by definition, is principally tasked with issuing bank notes for public circulation. A banknote is an expression of a note-issuing central bank’s liability. It is a credit note from the central bank to the bearer.

In the days of metallic coin standards, the central bank stood ready to redeem its notes for specie to members of the public on demand; specie being gold or silver coin and no one’s liability. Hence the words on a Bank of England ten-pound note, “I promise to pay the bearer on demand the sum of ten pounds”, signed by the Chief Cashier. Though with every new issue of banknotes, the promise’s script gets smaller and smaller…

Assuming the central bank maintains sufficient coin reserves — which was determined by Sir Isaac Newton no less to be a minimum of 40% of the note issue — then the risk of failure is minimal, and the notes circulate as credible substitutes for gold or silver coin, depending on the relevant standard.

But following England’s Great Recoinage of 1696 when milled edges were introduced to prevent coin clipping, a shortage of silver coin developed, forcing the Bank of England to suspend specie payments in exchange for its notes. Confidence in the value of the Bank’s notes slipped and they changed hands at a discount. The Bank had to be recapitalised, which was authorised by Act of Parliament. It was achieved by the Bank creating a loan for the Treasury, which was reapplied to the Bank’s balance sheet as an investment in it, bearing interest at 8%, instead of a deposit. Therefore, the Bank had an asset in the form of a loan to the Treasury and a matching liability, in the form of the Treasury’s capital subscription.

The same method of recapitalising a central bank would be applied today, presumably for additional capital in the form of equity. The Fed recently admitted that unrealised losses on the bonds on the asset side of its balance sheet stood at $330bn at end-March, which wipes out its balance sheet equity of $50bn more than six times over. Since then, bond yields have risen a further 1%, increasing the deficit to closer to $500bn. But in the Fed’s case, two differences from other central banks should be noted. First, the profile of US Treasury debt is shorter term in average maturity than in other advanced economies with high levels of government debt, confirmed by the Fed’s intention to retain debt to maturity rather than selling it. This means that price volatility is lessened. And secondly, some of the debt is agency debt (Fanny Mae, Ginny Mae, and Freddy Mac) which on early mortgage redemptions distributes payments to mortgage-backed securities holders. In effect, the maturity profile is shortened by these repayments, increasing their yield, and reducing their notional volatility.

Other central banks don’t have these benefits, at least to the same extent. The Bank of England has extracted a guarantee from the UK’s Treasury to cover any losses arising from its purchases of gilts which are all held in a special purpose vehicle. Consequently, the Bank does not have to record any balance sheet exposure to rising gilt yields. But the Bank of Japan and the ECB are in an entirely different situation. And so their ability to underwrite their commercial banking networks is extremely impaired.

The G-SIBs’ balance sheets have deteriorated significantly[i]

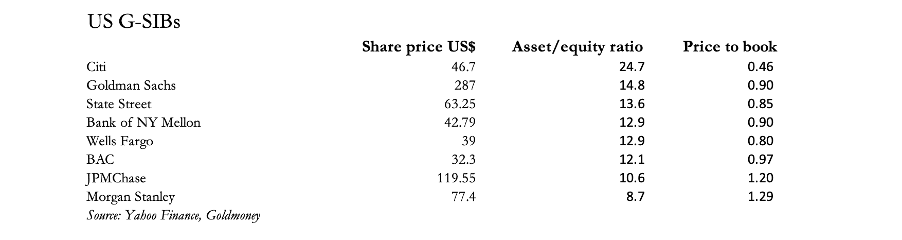

Global systemically important banks, the G-SIBs, are required by Basel regulations to carry extra liquidity buffers, reflecting their cross-border exposure. There are thirty of these banks so designated, one of which, Group BPCE, is not listed on a stock exchange so is omitted from our list. Table 1 below shows the financial condition of the remaining banks, listed from highest asset to lowest asset to common equity ratio.

It should be noted that other forms of primary capital than common equity shares are not allowed for in the table. Consequently, the price to book ratios make no allowance for preference shares and other forms of regulatory capital, where they exist. From a regulator’s viewpoint, these other forms of capital reduce the level of gearing substantially. Accordingly, Deutsche Bank appears to the regulator to be geared about twenty times, but so far as common shareholders are concerned, our table tells us the figure is closer to seventy. We are considering the position of the underlying, or common shareholders only, which is where a bank’s management is or should be focused.

Furthermore, while most balance sheets are for December 2021, some banks in different jurisdictions have other balance sheet dates and accounting conventions. And the figures for numbers of shares and total assets are lifted from the internet (Yahoo Finance), and not the audited accounts reported by the banks themselves.

The admission to possibilities of error having been made, to see any banks with asset to equity ratios for their ordinary shareholders of more than twenty times, let alone the two French G-SIBs which appear to be over seventy, is simply jaw-dropping.

This situation is mainly the consequence of bank regulation. The extra liquidity buffers required for G-SIBs by the Basel Committee are contained within the balance sheet, both in sources of finance and the nature of the assets held. Additionally, these G-SIBs are required to comply with the Basel 3 regulations in force, particularly net stable funding ratios. But the simplest and most important risk metric of all, the relationship between a bank’s assets and its common equity shareholders’ capital, has been wholly ignored. But markets are not so easily fooled, and one can see that in general terms, the greater the leverage for common shareholders the larger the discount to book value the shares possess.

Of particular concern is the bunching of risk, with the Eurozone’s G-SIB cohort most vulnerable to shocks, closely followed by the three Japanese banks. That banks in these two jurisdictions are the most highly leveraged groups is partly a consequence of negative interest rates. Credit margins have been tightly compressed, and so long as banking regulations are complied with, the management of these banks have been encouraged to maintain profitability by increasing credit leverage.

Furthermore, as discussed below, the European Central Bank and the Bank of Japan themselves will need to be recapitalised if they are to underwrite the losses in the commercial banking sector which are certain to quickly develop as interest rates rise and bank credit contracts.

On paper, the US G-SIBs are the second least highly leveraged groups, after the two Canadian G-SIBs. But bear in mind that the contraction of bank credit, which was so plainly signalled by Jamie Dimon recently, is designed to get capital ratios for common shareholders back to well under ten times.

The ECB’s impossible position

Economic reality and the ECB’s monetary policies have only occasionally had a tangential relationship, with the ECB bullying its way over markets. The falsity of its position is now being exposed.

Not only are the errors in its monetary policies being exposed, but now its underlying assumption, that it can ignore the little people in the real economies of the member states has been fatally undermined by the war in Ukraine. Eurozone banks face costly write-offs on their Ukrainian and Russian exposures, and these are problems shared by non-financial entities in the face of a global economic slowdown. The economic and financial impacts on the Eurozone are significant.

Clearly, non-performing loans are rapidly becoming an issue. Additionally, energy, food, and escalating producer prices will make the situation far worse in the coming months. The ability of the Eurozone’s banks to survive all these headwinds will be increasingly questioned. The news here is exceedingly grim, with balance sheet common equity to asset ratios in the stratosphere for the Eurozone G-SIBs. Local banks, upon which most of the non-financial burden of Eurozone credit defaults will fall will not be so highly leveraged, being run by sensible local and regional managers in the main. But in the deteriorating conditions the Eurozone now faces, even asset to equity ratios of as little as ten times could prove fatal to a bank’s future.

With respect to their underlying shareholders, the Eurozone’s G-SIBs are the most highly leveraged banking cohort. In the face of rising interest rates and the contraction of bank credit, there can be little doubt that the first G-SIB failures are likely to be among these banks. The ability of the ECB and its network of shareholding national central banks to weather a credit storm will be challenged and almost certainly found wanting.

At the end of 2021, the ECB’s balance sheet showed assets of €8,466bn and share capital of €109bn. That’s a ratio of assets to shareholder capital of 78 times. A high ratio is tolerable for a central bank so long as it sticks to issuing bank notes. But by last December the ECB had also accumulated Eurozone government and other bonds totalling €4,886bn.

Since the year-end, by last Friday the value of these bonds has fallen sharply, as shown in Table 2, of selected 10-year Eurozone government bonds.

Obviously, the ECB will have bought bonds with a range of maturities and of those issued by some Eurozone governments more than others. Furthermore, using this information to roughly estimate the effect of rising bond yields on the ECB’s balance sheet ignores subsequent additions. But just assuming an average loss of 25% on its bond holdings as of end-December, there is a loss to the ECB’s assets from this source alone of €1,222bn. That’s a valuation write-off of over eleven times the ECB’s capital account.

Furthermore, with CPI inflation in the Eurozone recorded at 8.1%, and with an energy and food crisis developing, bond yields are due to rise significantly above current levels. And that is before international markets impose risk premiums on what is a dangerously deteriorating situation. A recapitalisation of the ECB is due as a matter of urgency before it is called upon along with the relevant national central banks (NCBs — which are similarly insolvent) to undertake the rescue of the Eurozone’s G-SIBs. We can see from their exceptionally high gearing that they are likely to be the first victims of bank credit contraction.

But the ECB is in the unfortunate position of not having a government shareholder with which to recapitalise itself on the lines suggested earlier in this article. Instead, its shareholders are the national central banks, which in turn have similar balance sheet problems. And as the ECB’s insolvency problem becomes public knowledge, it is likely that the NCBs will be already turning to their governments for capital injections before they can even consider subscribing for shares in the ECB.

Most Eurozone governments can probably be easily persuaded into this course of action. But as the ECB’s largest shareholder the Bundesbank has an additional problem in that it is owed a net €1,135bn by the other NCBs and the ECB itself through the TARGET2 system — a big bag of writhing worms. Unless that problem is addressed, the enabling legislation is likely to be delayed in the Bundestag, and there could be obstructive rulings from the Federal Constitutional Court to contend with as well

There are no easy options. It is possible to conceive of a systemic failure at the central bank level threatening the existence of the euro itself. Certainly, the foreign exchanges are likely to be brutal in this matter.

Bank of Japan is in deepening trouble

The Bank of Japan has been conducting QE since 2000, and to date has accumulated 80% of the country’s ETFs amounting to 52 trillion yen ($420bn), as well as 538 trillion yen ($3.7 trillion) in bond purchases.[i] It appears that these investments are carried at cost on the BoJ’s balance sheet. The combined losses amount to approximately 14 trillion yen ($104bn) since the year-end compared with balance sheet capital consisting of equity and reserves of 4.7 trillion yen (USD35bn). That’s a rapidly rising ratio of net liabilities to capital of 3:1.

The Bank of Japan is trying to save itself from further financial embarrassment by ensuring bond yields rise no further. It has drawn a line in the sand for the 10-year JGB yield at 0.25% and has cleaned out the market at this maturity. The price is now in Humpty Dumpty territory: what the BoJ says is the price, is the price.

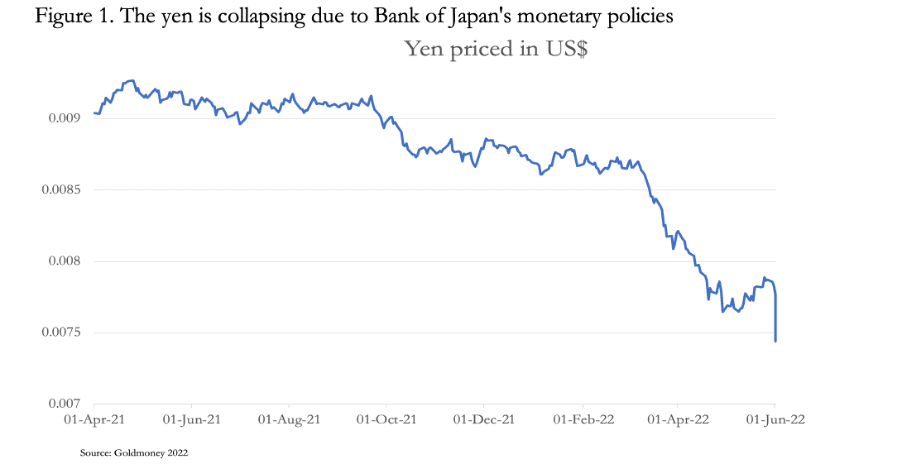

The cost has been yen weakness, which is now accelerating. Figure 1 shows the chart of the yen priced in US dollars.

The only solution to this problem is for the Bank of Japan to admit to the folly of its policy, recapitalise itself using the same method as the Bank of England back in 1697, and allow bond yields to be set in the market.

However, permitting yen interest rates to rise will lead to further problems for Japan’s commercial banks, which at equity shareholder level are very highly leveraged, as the table below illustrates.

That these banks are highly leveraged is reflected in their price to book values, which stand at substantial discounts. And no wonder. On these figures, exposure to bonds with maturities of more than a few years threatens to wipe out their equity before considering the consequences of collapsing loan collateral values in a downturn in economic activity.

The Bank of England has dug a hole for itself as well

The utterances of the current Governor reflect little more than the policy delusions of his international peers. To be fair to Andrew Bailey, the Office for National Statistics similarly has its head in the sand with respect to the domestic economy, and the advice upon which the Treasury relies. This quote illustrates the point:

“…we produce a medium-term forecast. Beyond the first couple of years of the forecast we typically assume that inflation returns to the 2 per cent target. The path of inflation back to target after our short-term forecast is informed by statistical models for individual elements of the CPI which are influenced by our forecasts for unit labour costs, exchange rates and the output gap.”[i]

The ONS has given the game away. The depth of their analysis is no more than that of the three wise monkeys. And worryingly, its forecasts are like those throughout the Western fiat world made by other governments and their monetary agencies.

Sensibly, the Bank of England anticipated the problem of collapsing bond prices undermining its balance sheet, having extracted an agreement from the Treasury that in return for all gilt dividends being remitted to it, the Treasury takes all the profits and losses on gilts acquired because of monetary policy. The Bank’s balance sheet therefore legitimately carries them at cost in a special purpose vehicle and is therefore in a better position than other central banks exposed to bond price risk.

When we look at gilt yields, they are clearly out of kilter with those of US Treasuries. At the time of writing, 10-year US Treasuries yield 3.42%, and gilts 2.52%. In our fiat currency world, it is normally assumed there should be a risk premium for holders of sterling fixed interest assets compared with those of the world’s reserve currency. The incorrect pricing of UK government debt is being reflected in the foreign exchanges, in the GBP rate.

As the financially based world of fiat-driven markets collapses under the inexorable rise of interest rates, a greater rise in gilt yields than of US Treasuries can be expected. For now, the mispricing is undermining the exchange rate, but that can be expected to lead to markets pricing the Bank’s interest rate policies as being even more behind the curve than the Fed’s.

The three British G-SIBs are uncomfortably positioned for these events, with Barclays and Standard Chartered shareholders particularly highly leveraged.

The Bank of England is better placed to underwrite its G-SIBs insolvencies than other central banks, because it does not need to recapitalise itself to do so. But with London being the global financial centre with exposure to the EU, a systemic banking problem is a racing certainty.

How will the Fed respond to global problems?

Except for Citi, US G-SIB asset to common equity ratios are among the lowest, bested only by the two Canadians. A systemic banking crisis is therefore unlikely to have its origin in the US, but through the reserve currency US G-SIBs are systemically interlinked with all the others. There is almost total reliance on bank regulation to minimise this risk.

The extent to which central banks rely on regulators and their stress tests to absolve them of responsibility is an important question. Because bank regulation had been separated from the Bank of England, at the time of the Lehman crisis the Bank was unaware of the risks securitisation posed to the financial system before they failed. That mistake has been rectified, but bank regulation is still compartmentalised within the Bank.

One suspects this is true in other jurisdictions, including the US. Regulatory bodies carrying out stress tests. And the centralisation of global regulation under Basel Committee rules seems bound to offer comfort to the Fed’s bureaucracy that with global cooperation their regulators are successfully identifying and containing systemic risks.

Nowhere in all the regulatory activity do we see a direct emphasis on asset to common equity ratios. We see restrictions on balance sheet capacity, but these are set by measures of liquidity and lending risk, not the size of a bank’s capital. It explains why, with margins compressed by minimal and even negative rate policies, commercial banks have been allowed, even encouraged, to expand their balance sheets without additional common shareholders’ capital. Tier One capital is enhanced by other means. It explains why some G-SIBs have even been buying in their own shares, presumably eyeing the discount to book values, without a peep being heard from regulators.

So, we should conclude that the structure of the regulatory system might have blinded the Fed, the Bank for International Settlements, and the other leading Western central banks to the consequences of bank credit contraction for banking’s common equity shareholders. Interest rates are belatedly being permitted by the Fed to rise as we saw with yesterday’s ¾ point hike. With a heavily doctored CPI showing prices rising at over 8%, going on 10% and more, a Fed funds rate of1.5%—1.75% is still a long way behind the curve. They are bound to go considerably higher, collapsing bond and financial collateral values. It will lead to a crisis in financial markets. And given that the commercial banks in the Eurozone and Japan possess extremely high shareholder leverage, that can be expected to occur very soon.

Unless the Fed is prepared to let markets sort this mess out — a course of action we can dismiss out of hand — the Fed’s only possible response will be to inflate the dollar to compensate for the contraction of bank credit. The means by which this will be done is not the point. There will be no alternative, as the Fed’s priority will be to save the financial system and to minimise the consequences for the wider American economy and particularly for the Federal Government’s finances. The other central banks mentioned in this article will have to follow suit, where they can. Expect swap lines between them to be expanded to enable them to do so. Expect bond markets to be closed by diktat, perhaps for more than a day or two. As helpless bystanders, we will all be looking into an abyss, fearful that there is no resolution to an unsolvable crisis.

Pre-planning an escape from the fiat-money system

With a perfect storm forming in financial markets and the banks, we are witnessing the end of a global economic system which has denied the realities of free markets ever since President Hoover believed that the US Government could improve and then save the American economy in 1929. His errors were magnified by the neo-Keynesians’ hero, Franklin Roosevelt with his New Deal. A Second World War and post-war socialisation of capital with a minimised gold standard followed. Every failure has been met with a new doubling down on capitalism.

And every failure has increased the power of the state over its people and diminished their freedom. The drift away from a world of progress, where people were free to exchange the fruits of their labour with the intermediation of sound money, enabling them to succeed or fail by their own efforts, has led to the ultimate failure: a looming collapse of the whole statist system.

Since the last fig-leaf of gold convertibility was finally abandoned fifty-one years ago, the final phase of our decline has been covered up by the increasing financialisation of western economies, substituting paper wealth for real prosperity. The function of fiat currency has been to perpetuate this illusion, an illusion that is finally coming to an end.

In the financial and economic violence which we now face, it is difficult to anticipate the order of a series of events within the overall crisis. The outturn could be very different, but logic suggests the following. Interest rates will rise until bank failures materialise. Meanwhile, financial assets will have fallen in value, possibly very quickly. Then we can expect monetary policy to expand to rescue the commercial banks, supress bond yields and to finance soaring government deficits.

It will be a rerun of John Law’s attempt at an inflationary rescue of his Mississippi bubble three hundred years ago, except this time it’s on a global scale and encompassing everything. In 1720, the Mississippi bubble collapsed first, followed by Law’s fiat livres. In the coming months, perhaps the currencies will initially survive the systemic crisis, to collapse shortly after. At this side of the crisis, which is only in its initial stages, the euro is slated as the first currency to collapse entirely, not just because it is a fiat designed by committee, but because of the depth of the structural problems in the ECB and its shareholders.

In these circumstances, the authorities will almost certainly become desperate. They commence from a position of believing the faults lie with markets and will seek new ways to supress them further. Along with commodities, energy, and food prices we can expect gold and silver prices to soar. Will the authorities respond by suppressing prices like latter day Diocletians, banning gold ownership as well? These would be stupid moves, but extremely likely. Gold markets could be simply closed, denying access to those belatedly fleeing fiat.

The neo-Keynesians in charge of markets which they barely understand still think that owning dollar deposits is the ultimate safety. Hedge fund managers, anticipating currency flows, see prospects for dollar strength, but that is only on the foreign exchanges. Since they only deal in paper, they are easily persuaded to sell gold futures and forwards and buy dollars. The bullion banks running short positions are happy to encourage this trend to square their books.

It presents an enormous opportunity for anyone who truly understands money and the reasons why the fiat world is going to hell in a handcart. These few people understand that the reason for buying physical gold is to escape the fiat world, and that it must be bought while there is some available and permitted.

[ii The list of G-SIBs can be found here: https://www.fsb.org/wp-content/uploads/P231121.pdf

[ii] See https://www.tbsnews.net/analysis/430b-cautionary-tale-inside-japans-central-bank-400938 The figure for JGB bonds is taken from the Bank of Japan’s most recent balance sheet.

[iii] See https://obr.uk/forecasts-in-depth/the-economy-forecast/inflation/#CPI

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.